Rubén Weinsteiner

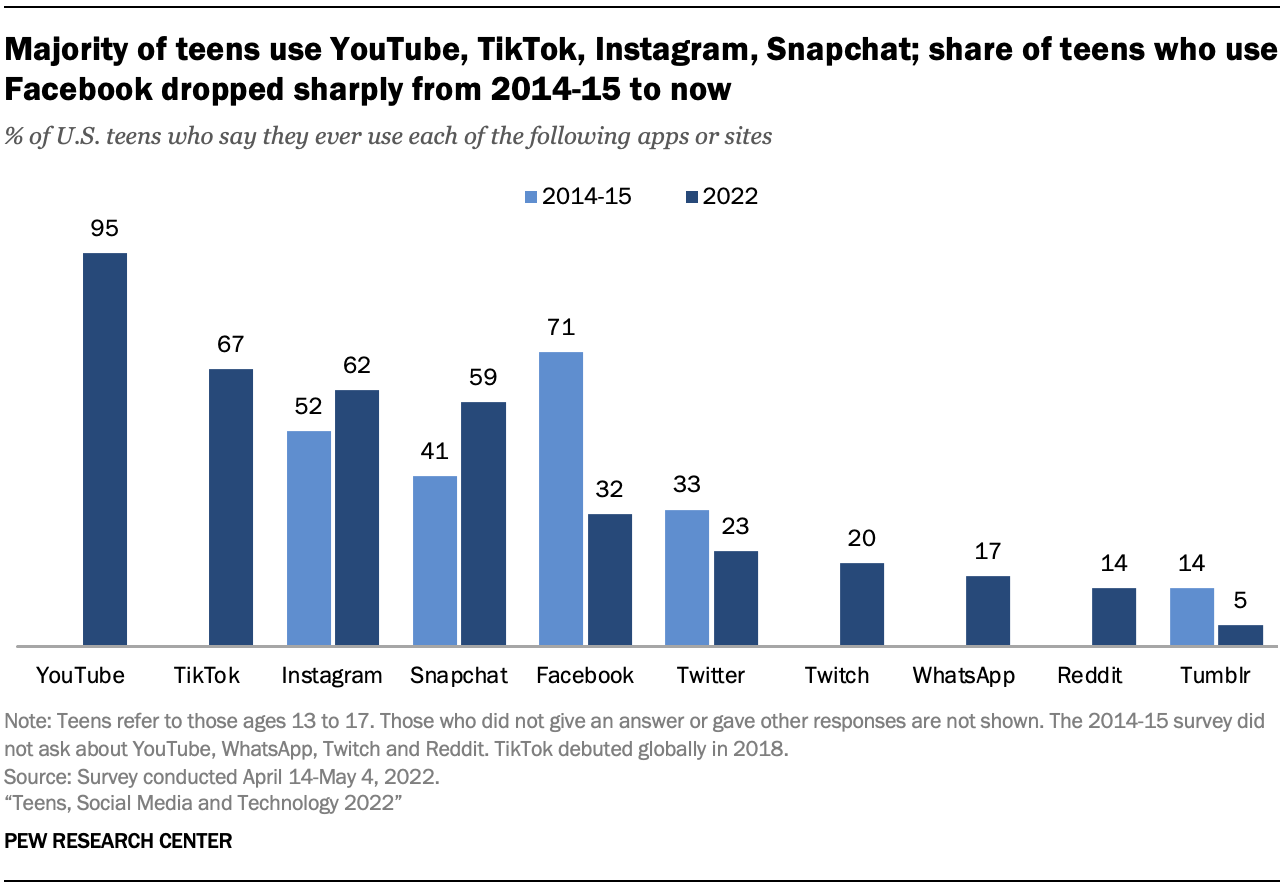

TikTok

has established itself as one of the top online platforms for U.S.

teens, while the share of teens who use Facebook has fallen sharply

How we did this

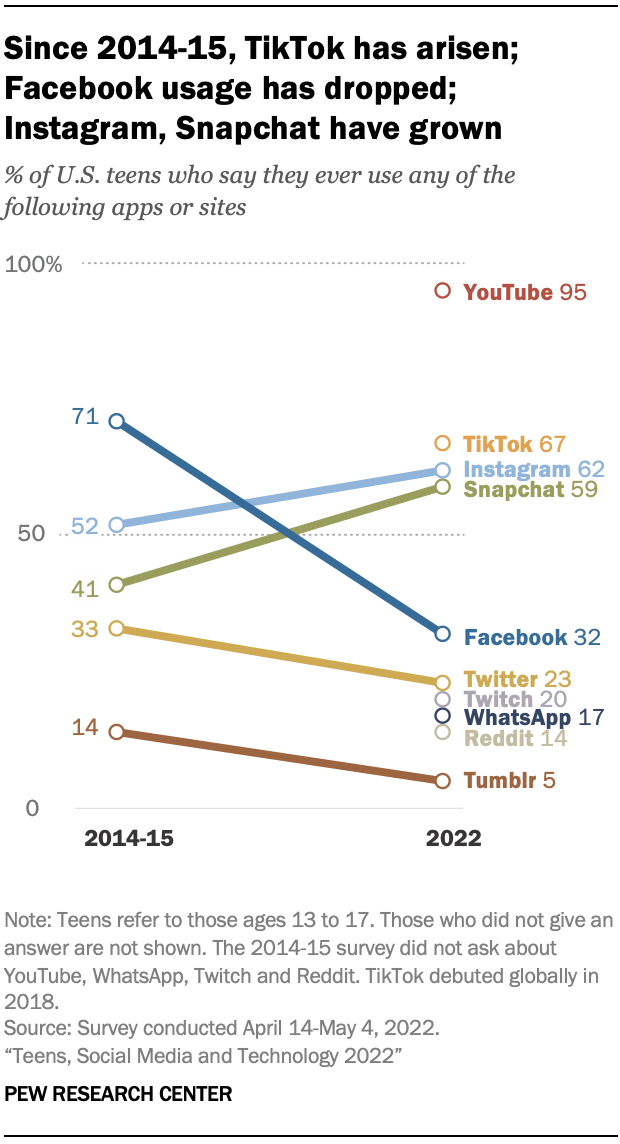

The landscape of social media is ever-changing, especially among teens who often are on the leading edge

of this space. A new MARCA POLITICA survey of American teenagers ages

13 to 17 finds TikTok has rocketed in popularity since its North American debut several years ago

and now is a top social media platform for teens among the platforms

covered in this survey. Some 67% of teens say they ever use TikTok, with

16% of all teens saying they use it almost constantly. Meanwhile, the

share of teens who say they use Facebook, a dominant social media

platform among teens in the Center’s 2014-15 survey, has plummeted from 71% then to 32% today.

YouTube

tops the 2022 teen online landscape among the platforms covered in the

Center’s new survey, as it is used by 95% of teens. TikTok is next on

the list of platforms that were asked about in this survey (67%),

followed by Instagram and Snapchat, which are both used by about

six-in-ten teens. After those platforms come Facebook with 32% and

smaller shares who use Twitter, Twitch, WhatsApp, Reddit and Tumblr.1

Changes

in the social media landscape since 2014-15 extend beyond TikTok’s rise

and Facebook’s fall. Growing shares of teens say they are using

Instagram and Snapchat since then. Conversely, Twitter and Tumblr saw

declining shares of teens who report using their platforms. And two of

the platforms the Center tracked in the earlier survey – Vine and

Google+ – no longer exist.

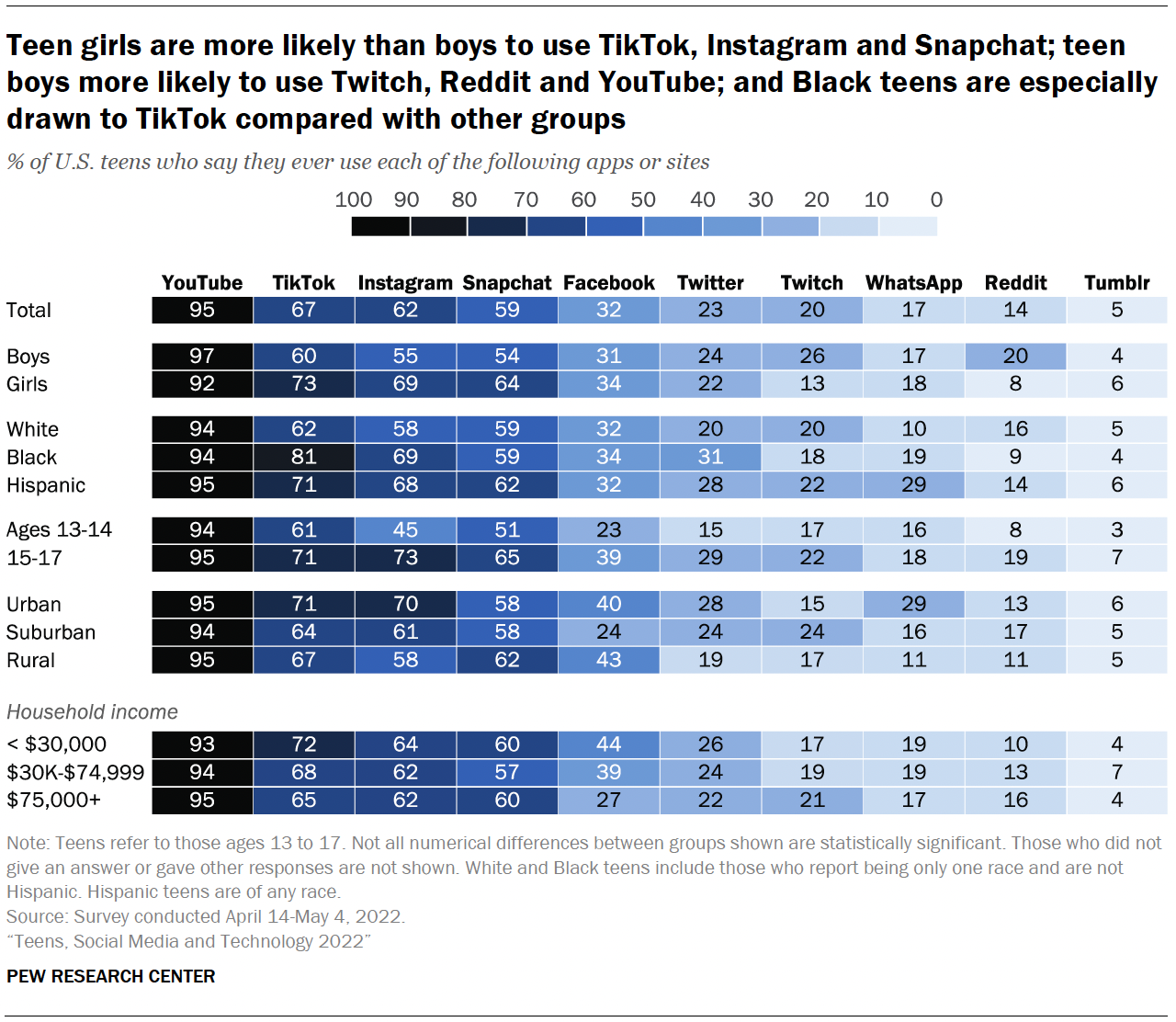

There are some notable demographic

differences in teens’ social media choices. For example, teen boys are

more likely than teen girls to say they use YouTube, Twitch and Reddit,

whereas teen girls are more likely than teen boys to use TikTok,

Instagram and Snapchat. In addition, higher shares of Black and Hispanic

teens report using TikTok, Instagram, Twitter and WhatsApp compared

with White teens.2

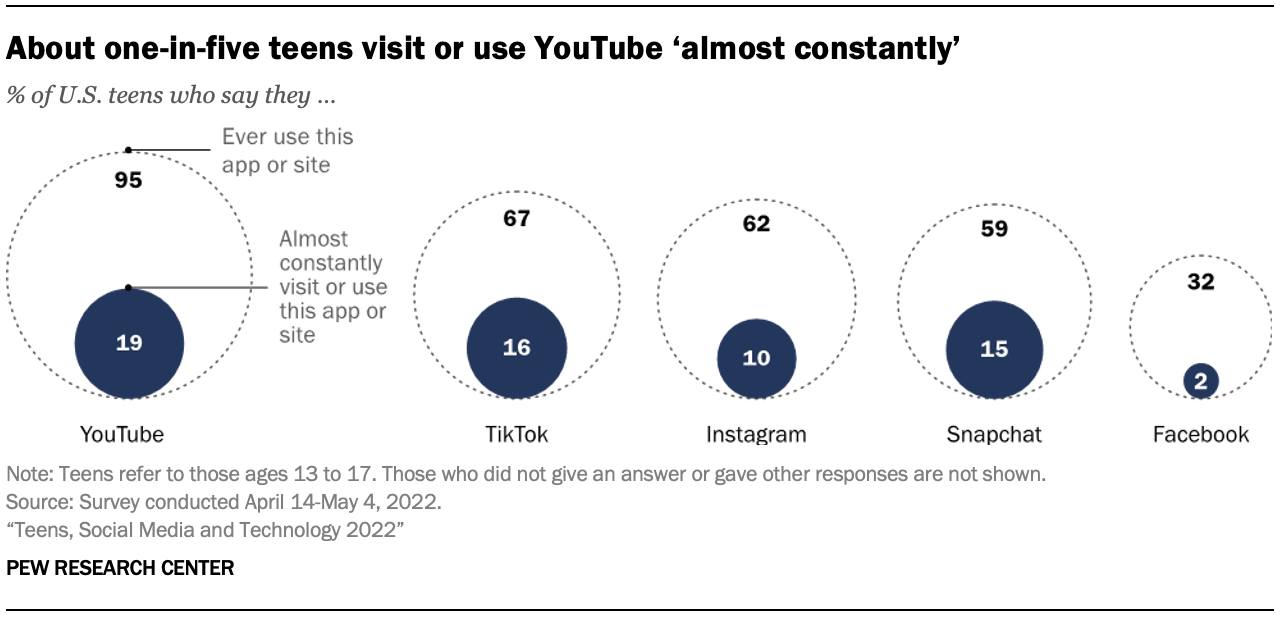

This

study also explores the frequency with which teens are on each of the

top five online platforms: YouTube, TikTok, Instagram, Snapchat and

Facebook. Fully 35% of teens say they are using at least one of them

“almost constantly.” Teen TikTok and Snapchat users are particularly

engaged with these platforms, followed by teen YouTube users in close

pursuit. A quarter of teens who use Snapchat or TikTok say they use

these apps almost constantly, and a fifth of teen YouTube users say the

same. When looking at teens overall, 19% say they use YouTube almost

constantly, 16% say this about TikTok, and 15% about Snapchat.

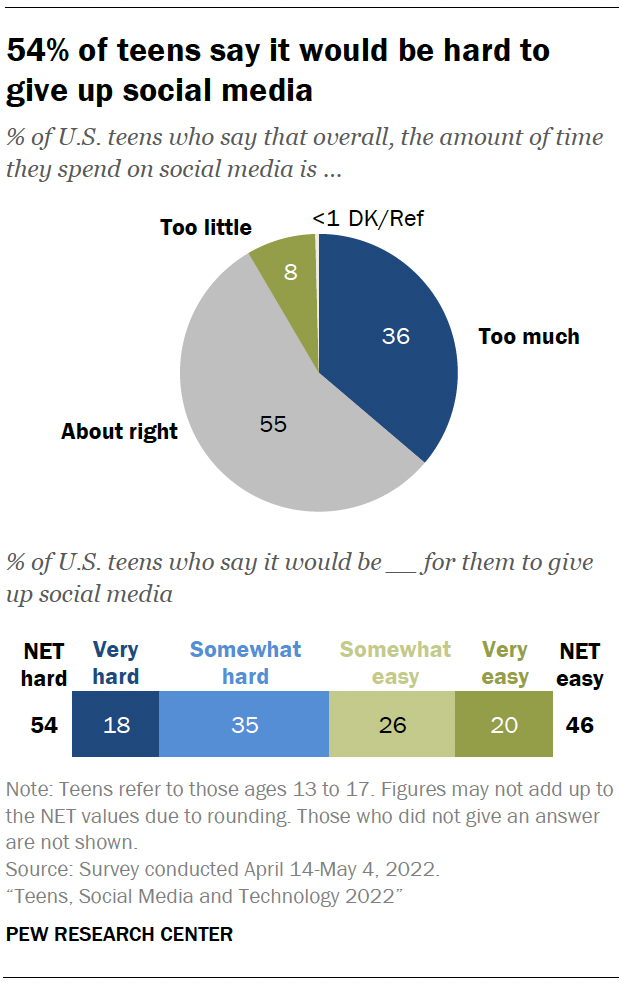

When

reflecting on the amount of time they spend on social media generally, a

majority of U.S. teens (55%) say they spend about the right amount of

time on these apps and sites, while about a third of teens (36%) say

they spend too much time on social media. Just 8% of teens think they

spend too little time on these platforms.

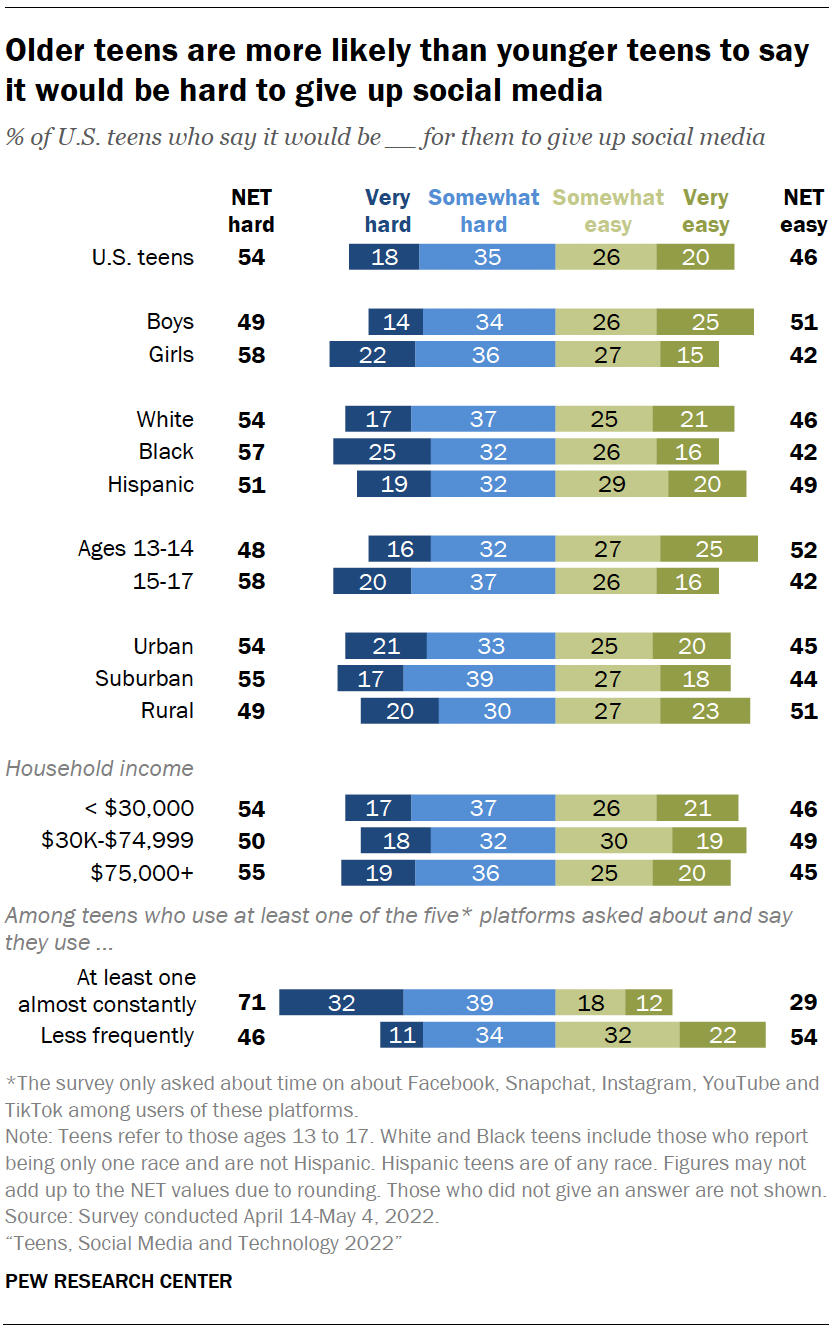

Asked about the idea

of giving up social media, 54% of teens say it would be at least

somewhat hard to give it up, while 46% say it would be at least somewhat

easy. Teen girls are more likely than teen boys to express it would be

difficult to give up social media (58% vs. 49%). Conversely, a quarter

of teen boys say giving up social media would be very easy, while 15% of

teen girls say the same. Older teens also say they would have

difficulty giving up social media. About six-in-ten teens ages 15 to 17

(58%) say giving up social media would be at least somewhat difficult to

do. A smaller share of 13- to 14-year-olds (48%) think this would be

difficult.

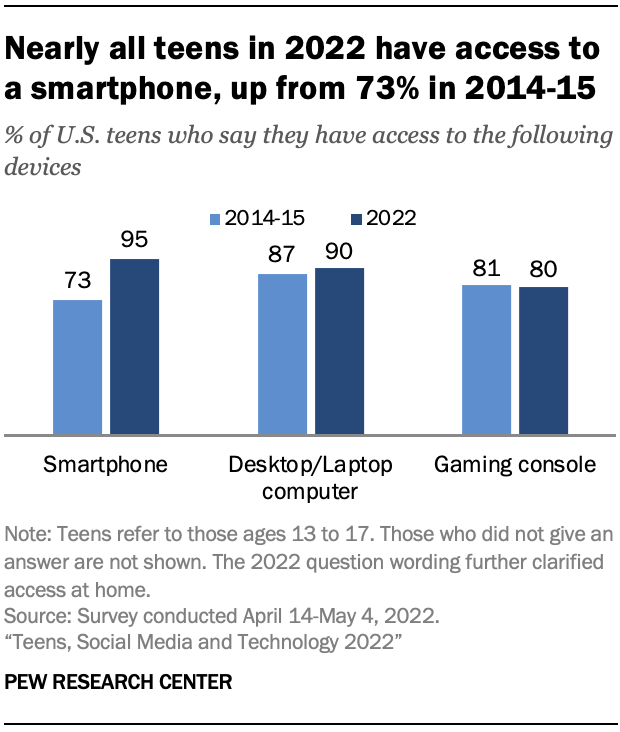

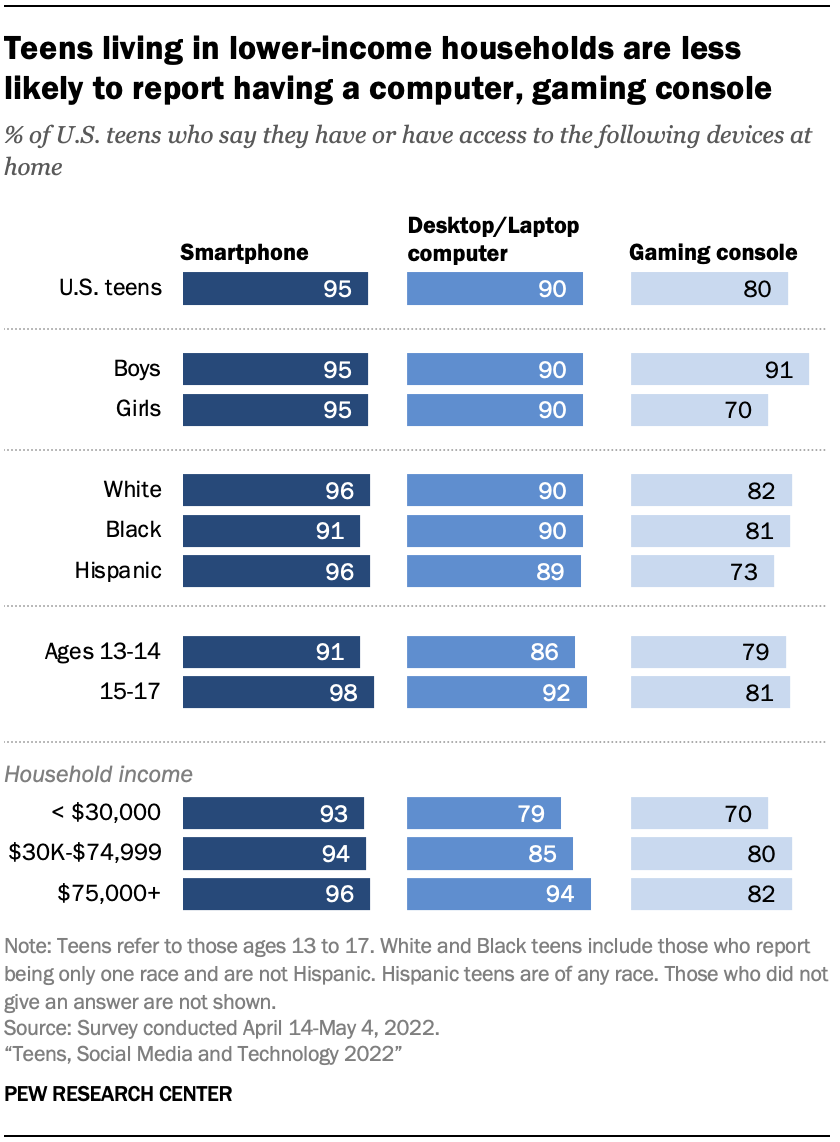

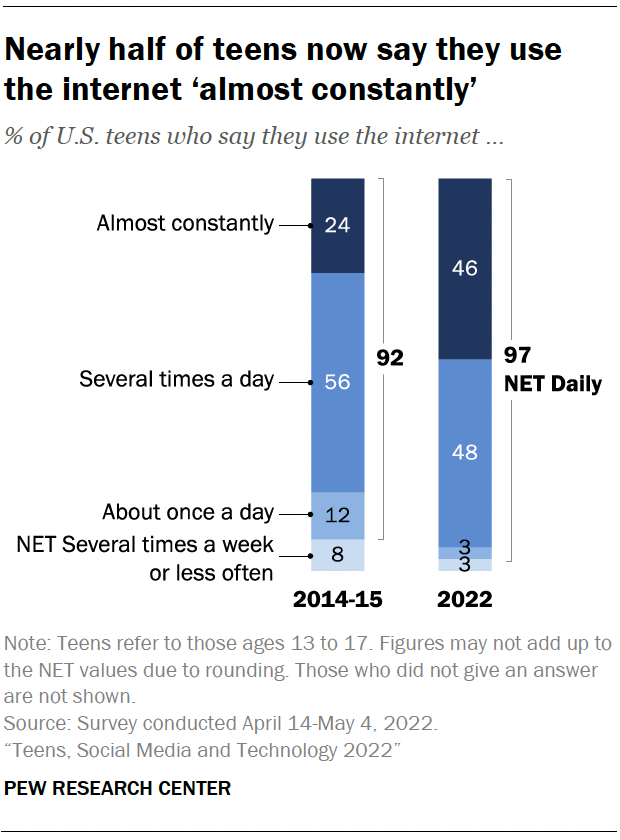

Beyond just online platforms, the new survey finds

that the vast majority of teens have access to digital devices, such as

smartphones (95%), desktop or laptop computers

(90%) and gaming consoles (80%). And the study shows there has been an

uptick in daily teen internet users, from 92% in 2014-15 to 97% today.

In addition, the share of teens who say they are online almost

constantly has roughly doubled since 2014-15 (46% now and 24% then).

These

are some of the findings from an online survey of 1,316 teens conducted

by the Pew Research Center from April 14 to May 4, 2022. More details

about the findings on adoption and use of digital technologies by teens

are covered below.

Smartphones, desktop and laptop computers, and gaming consoles remain widely accessible to teens

Since

2014-15, there has been a 22 percentage point rise in the share of

teens who report having access to a smartphone (95% now and 73% then).

While teens’ access to smartphones has increased over roughly the past

eight years, their access to other digital technologies, such as desktop

or laptop computers or gaming consoles, has remained statistically

unchanged.

The survey shows there are differences in access to

these digital devices for certain groups. For instance, teens ages 15 to

17 (98%) are more likely to have access to a smartphone than their 13-

to 14-year-old counterparts (91%). In addition, teen boys are 21 points

more likely to say they have access to gaming consoles than teen girls –

a pattern that has been reported in prior Center research.3

Access

to computers and gaming consoles also differs by teens’ household

income. U.S. teens living in households that make $75,000 or more

annually are 12 points more likely to have access to gaming consoles and

15 points more likely to have access to a desktop or laptop computer

than teens from households with incomes under $30,000. These gaps in

teen computer and gaming console access are consistent with digital divides by household income the Center has observed in previous teen surveys.

While

72% of U.S. teens say they have access to a smartphone, a computer and a

gaming console at home, more affluent teens are particularly likely to

have access to all three devices. Fully 76% of teens that live in

households that make at least $75,000 a year say they have or have

access to a smartphone, a gaming console and a desktop or laptop

computer, compared with smaller shares of teens from households that

make less than $30,000 or teens from households making $30,000 to

$74,999 a year who say they have access to all three (60% and 69% of

teens, respectively).

Almost all U.S. teens report using the internet daily

The

share of teens who say they use the internet about once a day or more

has grown slightly since 2014-15. Today, 97% of teens say they use the

internet daily, compared with 92% of teens in 2014-15 who said the same.

In addition, the share of teens who say they use the internet

almost constantly has gone up: 46% of teens say they use the internet

almost constantly, up from only about a quarter (24%) of teenagers who

said the same in 2014-15.

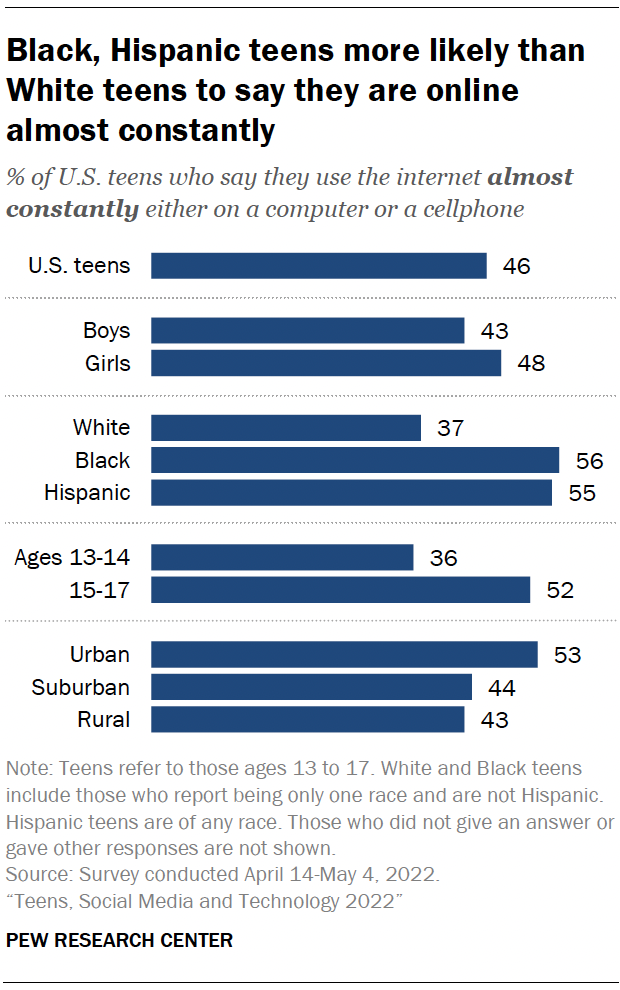

Black

and Hispanic teens stand out for being on the internet more frequently

than White teens. Some 56% of Black teens and 55% of Hispanic teens say

they are online almost constantly, compared with 37% of White teens. The

difference between Hispanic and White teens on this measure is

consistent with previous findings when it comes to frequent internet use.

In

addition, older teens are more likely to be online almost constantly.

Some 52% of 15- to 17-year-olds say they use the internet almost

constantly, while 36% of 13- to 14-year-olds say the same. Another

demographic pattern in “almost constant” internet use: 53% of urban

teens report being online almost constantly, while somewhat smaller

shares of suburban and rural teens say the same (44% and 43%,

respectively).

Slight differences are seen among those who say

they engage in “almost constant” internet use based on household income.

A slightly larger share of teens from households making $30,000 to

$74,999 annually report using the internet almost constantly, compared

with teens from homes making at least $75,000 (51% and 43%,

respectively). Teens who live in households making under $30,000 do not

significantly differ from either group.

The social media landscape has shifted

This

survey asked whether U.S. teens use 10 specific online platforms:

YouTube, TikTok, Instagram, Snapchat, Facebook, Twitter, Twitch,

WhatsApp, Reddit and Tumblr.

YouTube stands out as the most

common online platform teens use out of the platforms measured, with 95%

saying they ever use this site or app. Majorities also say they use

TikTok (67%), Instagram (62%) and Snapchat (59%). Instagram and Snapchat

use has grown since asked about in 2014-15, when roughly half of teens

said they used Instagram (52%) and about four-in-ten said they used

Snapchat (41%).

The

share of teens using Facebook has declined sharply in the past decade.

Today, 32% of teens report ever using Facebook, down 39 points since

2014-15, when 71% said they ever used the platform. Although today’s

teens do not use Facebook as extensively as teens in previous years, the

platform still enjoys widespread usage among adults, as seen in other recent Center studies.

Other

social media platforms have also seen decreases in usage among teens

since 2014-15. Some 23% of teens now say they ever use Twitter, compared

with 33% in 2014-15. Tumblr has seen a similar decline. While 14% of

teens in 2014-15 reported using Tumblr, just 5% of teens today say they

use this platform.

The online platforms teens flock to differ

slightly based on gender. Teen girls are more likely than teen boys to

say they ever use TikTok, Instagram and Snapchat, while boys are more

likely to use Twitch and Reddit. Boys also report using YouTube at

higher rates than girls, although the vast majority of teens use this

platform regardless of gender.

Teens’

use of certain online platforms also differs by race and ethnicity.

Black and Hispanic teens are more likely than White teens to say they

ever use TikTok, Instagram, Twitter or WhatsApp. Black teens also stand

out for being more likely to use TikTok compared with Hispanic teens,

while Hispanic teens are more likely than their peers to use WhatsApp.

Older

teens are more likely than younger teens to say they use each of the

online platforms asked about except for YouTube and WhatsApp. Instagram

is an especially notable example, with a majority of teens ages 15 to 17

(73%) saying they ever use Instagram, compared with 45% of teens ages

13 to 14 who say the same (a 28-point gap).

Despite Facebook

losing its dominance in the social media world with this new cohort of

teens, higher shares of those living in lower- and middle-income

households gravitate toward Facebook than their peers who live in more

affluent households: 44% of teens living in households earning less than

$30,000 a year and 39% of teens from households earning $30,000 to less

than $75,000 a year say they ever use Facebook, while 27% of those from

households earning $75,000 or more a year say the same. Differences in

Facebook use by household income were found in previous Center surveys as well (however the differences by household income were more pronounced in the past).

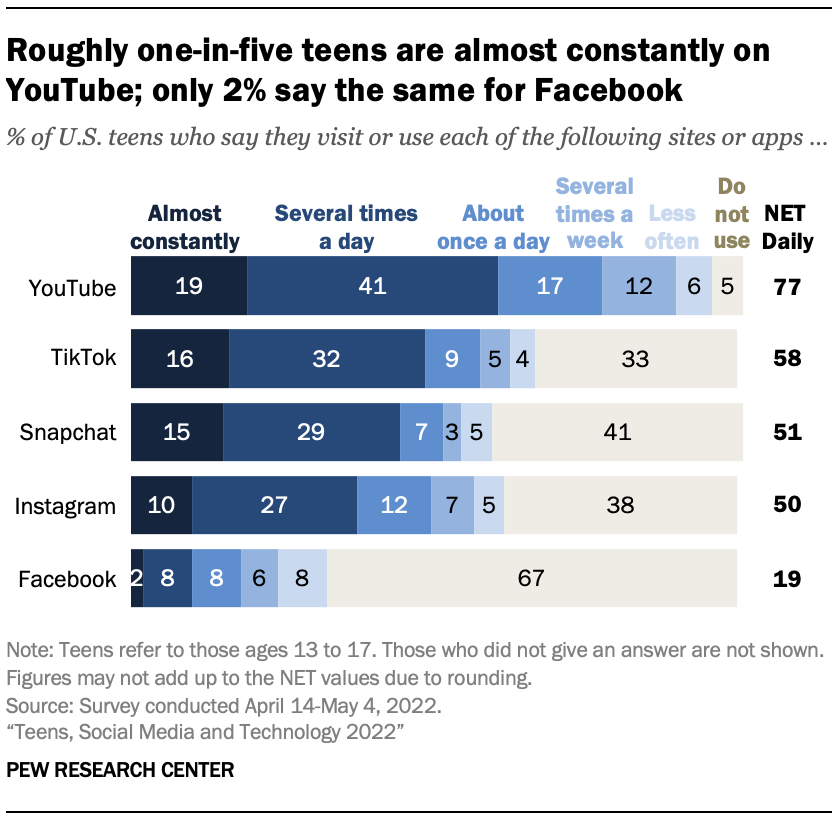

When

it comes to the frequency that teens use the top five platforms the

survey looked at, YouTube and TikTok stand out as the platforms teens

use most frequently. About three-quarters of teens visit YouTube at

least daily, including 19% who report using the site or app almost

constantly. A majority of teens (58%) visit TikTok daily, while about

half say the same for Snapchat (51%) and Instagram (50%).

Looking

within teens who use a given platform, TikTok and Snapchat stand out

for having larger shares of teenage users who visit these platforms

regularly. Fully 86% of teen TikTok or Snapchat users say they are on

that platform daily and a quarter of teen users for both of these

platforms say they are on the site or app almost constantly. Somewhat

smaller shares of teen YouTube users (20%) and teen Instagram users

(16%) say they are on those respective platforms almost constantly

(about eight-in-ten teen users are on these platforms daily).

Not

only is there a smaller share of teenage Facebook users than there was

in 2014-15, teens who do use Facebook are also relatively less frequent

users of the platform compared with the other platforms covered in this

survey. Just 7% of teen Facebook users say they are on the site or app

almost constantly (representing 2% of all teens). Still, about

six-in-ten teen Facebook users (57%) visit the platform daily.

Across

these five platforms, 35% of all U.S. teens say they are on at least

one of them almost constantly. While this is not a comprehensive rundown

of all teens who use any kind of online platform almost constantly,

this 35% of teens represent a group of relatively heavy platform users

and they clearly have different views about their use of social media

compared with those who say they use at least one of these platforms,

though less often than “almost constantly.” Those findings are covered

in a later section.

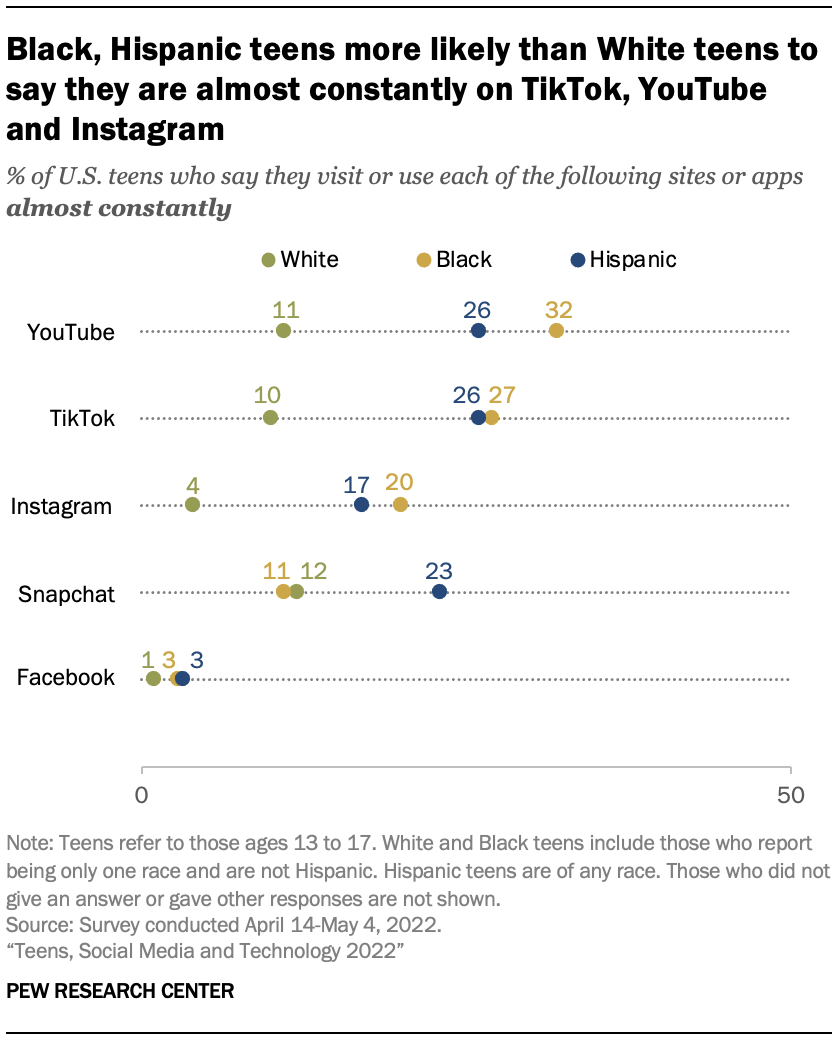

Larger

shares of Black and Hispanic teens say they are on TikTok, YouTube and

Instagram almost constantly than White teens. For example, Black and

Hispanic teens are roughly five times more likely than White teens to

say they are on Instagram almost constantly.

Hispanic teens are

more likely to be frequent users of Snapchat than White or Black teens:

23% of Hispanic teens say they use this social media platform almost

constantly, while 12% of White teens and 11% of Black teens say the

same. There are no racial and ethnic differences in teens’ frequency of

Facebook usage.

Overall, Hispanic (47%) and Black teens (45%)

are more likely than White teens (26%) to say they use at least one of

these five online platforms almost constantly.

Slight majorities of teens see the amount of time they spend on social media as about right and say it would be hard to give up

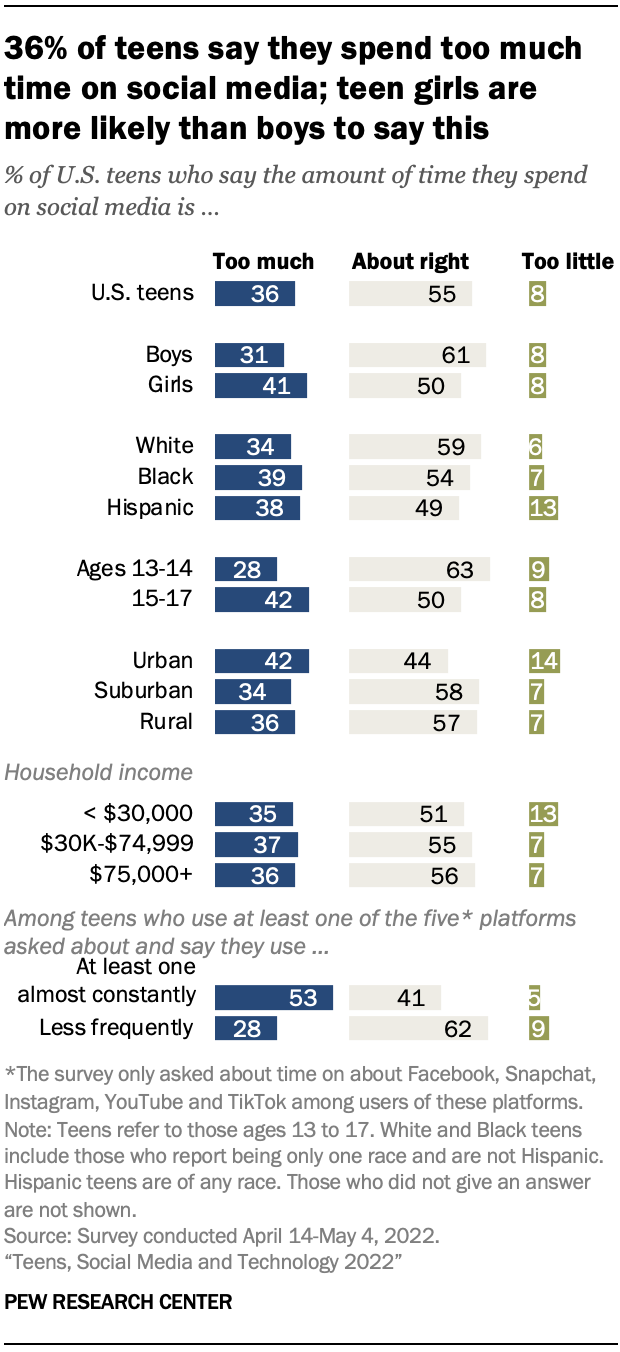

As

social media use has become a common part of many teens’ daily routine,

the Center asked U.S. teens how they feel about the amount of time they

are spending on social media. A slight majority (55%) say the amount of

time they spend of social media is about right, and smaller shares say

they spend too much time or too little time on these platforms.

While

a majority of teen boys and half of teen girls say they spend about the

right amount of time on social media, this sentiment is more common

among boys. Teen girls are more likely than their male counterparts to

say they spend too much time on social media. In addition, White teens

are more likely to see their time using social media as about right

compared with Hispanic teens. Black teens do not differ from either

group.

This analysis also explored how teens who frequently use

these platforms may feel about their time on them and how those feelings

may differ from teens who use these sites and apps less frequently. To

do this, two groups were constructed. The first group is the 35% of

teens who say they use at least one of the five platforms this survey

covered – YouTube, TikTok, Instagram, Snapchat or Facebook – almost

constantly. The other group consists of teens who say they use these

platforms but not as frequently – that is, they use at least one of

these five platforms but use them less often than “almost constantly.”

When

asked how they feel about the time they spend on social media, 53% of

teens who almost constantly use at least one of the platforms say they

are on social media too much, while about three-in-ten teens (28%) who

use at least one of these platforms but less often say the same.

Teens

who are almost constantly online – not just on social media – also

stand out for saying they spend too much time on social media: 51% say

they are on social media too much. By comparison, 26% of teens who are

online several times a day say they are on social media too much.

When

reflecting on what it would be like to try to quit social media, teens

are somewhat divided whether this would be easy or difficult. Some 54%

of U.S. teens say it would be very (18%) or somewhat hard (35%) for them

to give up social media. Conversely, 46% of teens say it would be at

least somewhat easy for them to give up social media, with a fifth

saying it would be very easy.

Teenage girls are slightly more

likely to say it would be hard to give up social media than teen boys

(58% vs. 49%). A similar gap is seen between older and younger teens,

with teens 15 to 17 years old being more likely than 13- and

14-year-olds to say it would be at least somewhat hard to give up social

media.

A majority of teens who use at least one of the

platforms asked about in the survey “almost constantly” say it would be

hard to give up social media, with 32% saying it would be very hard.

Smaller shares of teens who use at least one of these online platforms

but use them less often say the same.

The teens who think they

spend too much time on social media also report they would struggle to

step back completely from it. Teens who say they spend too much time on

social media are 36 percentage points more likely than teens who see

their usage as about right to say giving up social media would be hard

(78% vs. 42%). In fact, about three-in-ten teens who say they use social

media too much (29%) say it would be very hard for them to give up

social media. Conversely, a majority of teens who see their social media

usage as about right (58%) say that it would be at least somewhat easy

for them to give it up.

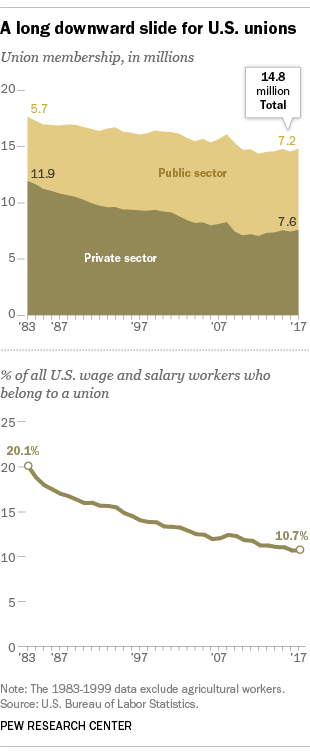

Despite

those fairly benign views, unionization rates in the United States have

dwindled in recent decades (even though, in the past few years, the

absolute number of union members has grown slightly). As of 2017, just

10.7% of all wage and salary workers were union members, matching the

Despite

those fairly benign views, unionization rates in the United States have

dwindled in recent decades (even though, in the past few years, the

absolute number of union members has grown slightly). As of 2017, just

10.7% of all wage and salary workers were union members, matching the  Manufacturing-type jobs, both union and non-union,

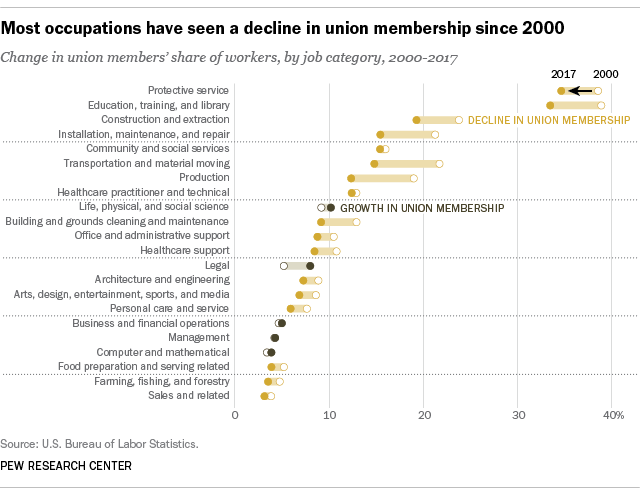

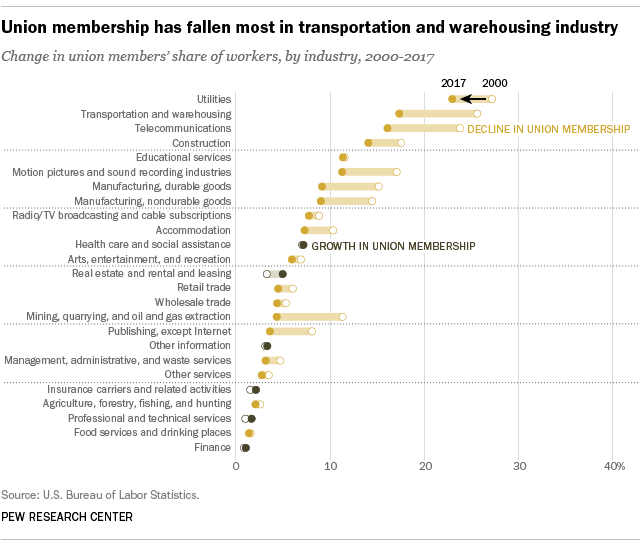

Manufacturing-type jobs, both union and non-union,  Not

all the news is bleak for labor unions. The total number of unionized

workers has grown modestly in recent years: up about 451,000 between

2012 and 2017, to just over 14.8 million. Most of that increase has

occurred in two occupational categories: construction and extraction

workers and healthcare practitioners and technicians. The construction

industry, which was hammered (so to speak) by the housing collapse a

decade ago, has recovered most of the 2.2 million jobs it shed between

2006 and 2010. The health care and social assistance industry was barely

affected by the Great Recession, and has added more than 1.7 million

jobs in the past six years alone.

Not

all the news is bleak for labor unions. The total number of unionized

workers has grown modestly in recent years: up about 451,000 between

2012 and 2017, to just over 14.8 million. Most of that increase has

occurred in two occupational categories: construction and extraction

workers and healthcare practitioners and technicians. The construction

industry, which was hammered (so to speak) by the housing collapse a

decade ago, has recovered most of the 2.2 million jobs it shed between

2006 and 2010. The health care and social assistance industry was barely

affected by the Great Recession, and has added more than 1.7 million

jobs in the past six years alone.