Demystifying the digital databases widely used by political campaigns

Since the rise of modern survey research, much of what is known about voter attitudes, behavior and the composition of the electorate has come from interviews with samples of voters, sometimes in combination with aggregate voting statistics. But relatively recent technological innovations and government policy changes have given political practitioners and researchers a new addition to their toolbox: national digital databases, or “voter files.” These files are built by commercial organizations using official, publicly available government records of who is registered to vote and who cast ballots in past elections.

As research and targeting using these voter files has become more widespread, voter file vendors are increasingly trying to provide coverage of all U.S. adults, including those who are not registered to vote. These commercially available files provide not only a nationwide picture of voter registration and turnout, but are usually supplemented with information from consumer data vendors, credit bureaus, political organizations and other sources and are marketed as providing a rich and comprehensive record for nearly every American adult.

Over the last decade, commercial voter files have become central to the conduct of contemporary election campaigns and are frequently employed by pollsters, journalists and political analysts trying to understand the American electorate. As part of a broader effort at Pew Research Center to shed light on this important but somewhat arcane resource, this report focuses on using the files to enhance our understanding of survey respondents. It also attempts to evaluate the quality of the data provided by the files.

In order to accomplish these goals, voter file data acquired from five commercial vendors were matched to participants in Pew Research Center’s American Trends Panel, a nationally representative sample of adults who have agreed to take surveys on a regular basis. This offers an opportunity to compare self-reported voter registration and turnout data provided by panelists – data that are subject to well-documented survey errors – to the high-quality official vote records included in the voter files. It also provides a chance to use data acquired from survey interviews with panelists to verify the accuracy of the ancillary information that commercial vendors attach to the voter files, including additional demographic, financial, lifestyle and political data.

The data sources

To describe and evaluate voter files, Pew Research Center attempted to link all of the nearly 5,000 members of the American Trends Panel (ATP), its nationally representative survey panel of U.S. adults, to five commercial voter files. Two of the files are from nonpartisan vendors, two are from vendors that work primarily with Democratic and politically progressive clients and one is from a vendor that works primarily with Republican and politically conservative clients. The vendors are anonymized and numbered from one to five in this report, ordered by the rate at which the voter file records were matched to members of the panel.

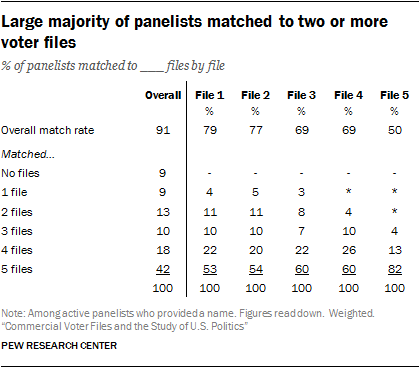

All vendors were provided with the same panelist information for searching, which included their name, address, gender, phone number, race and ethnicity, date of birth or age and email address. Vendors were then asked to find these individuals in their voter files using their normal matching methodology. The vendors then provided Center researchers with voter file data on voter registration and turnout, party affiliation and demographic characteristics for each panelist they were able to match. Vendors were obligated to maintain this information in strict confidence and to permanently delete all personally identifying information about panelists when the matching was completed. Overall, 91% of the 3,985 active members of the ATP who took part in a survey conducted Nov. 29 to Dec. 12, 2016 (and who provided a name) yielded a match by at least one of the vendors.1

All vendors were provided with the same panelist information for searching, which included their name, address, gender, phone number, race and ethnicity, date of birth or age and email address. Vendors were then asked to find these individuals in their voter files using their normal matching methodology. The vendors then provided Center researchers with voter file data on voter registration and turnout, party affiliation and demographic characteristics for each panelist they were able to match. Vendors were obligated to maintain this information in strict confidence and to permanently delete all personally identifying information about panelists when the matching was completed. Overall, 91% of the 3,985 active members of the ATP who took part in a survey conducted Nov. 29 to Dec. 12, 2016 (and who provided a name) yielded a match by at least one of the vendors.1

Summary of findings

Commercial voter files are an amalgamation of administrative data from states about registration and voting, modeled data about partisanship, political engagement and political support provided by vendors; and demographic, financial and lifestyle data culled from a wide range of sources. Bringing together data from a number of different sources brings challenges, as each source comes with its own strengths and weaknesses. A principal goal of this study was to assess the accuracy and completeness of the information in the commercial voter files. For most of the analyses, information provided by respondents in the American Trends Panel is used to assess the quality of the information in the voter files. Here are some of the most important findings, followed by additional detail from the analysis:

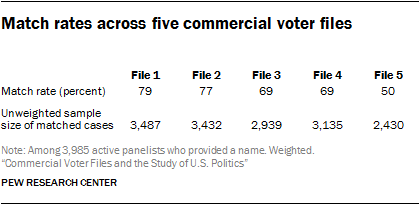

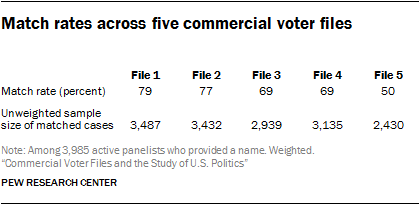

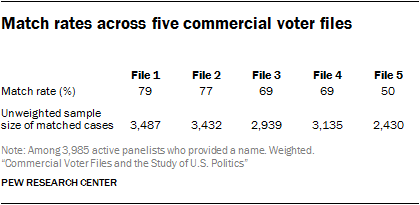

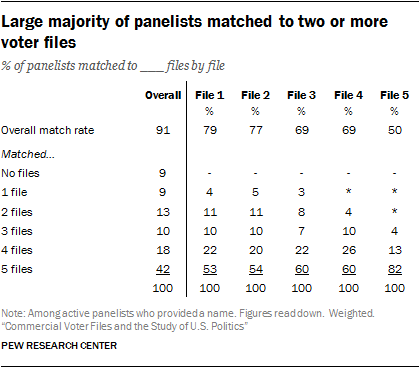

Researchers were able to match a very high percentage of panelists from the nationally representative survey sample to at least one of the five commercial voter files, suggesting that the files collectively cover a large share of the U.S. population. Depending on the voter file vendor, the percentage of panelists matched varied from a low of 50% to a high of 79%, with an average match rate of 69%. Less than half (42%) of the panelists were located in all five files, but each of the vendors “found” panelists missed by other vendors. Differences among the vendors are largely a function of their tolerance for mismatches and, presumably, the success of their matching algorithms. Collectively, the vendors successfully matched 91% of panelists, meaning that more than nine-in-ten panelists could be found on at least one of the files and just 9% of panelists could not be found on any of the files. The relatively high level of coverage of the files is encouraging for researchers and campaigns that use them for targeting, messaging or research. Of course, most clients using these voter files will not have purchased all five of them, so match rates of 90% and higher may be difficult if not impossible to achieve with any single file.

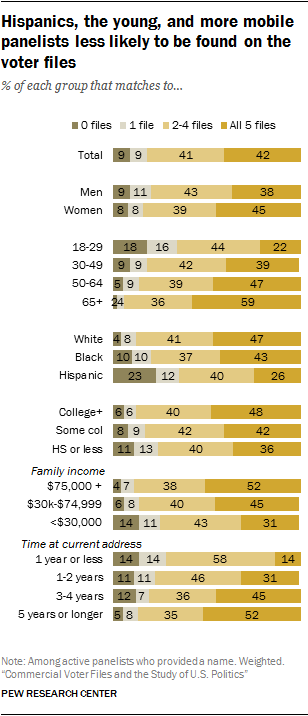

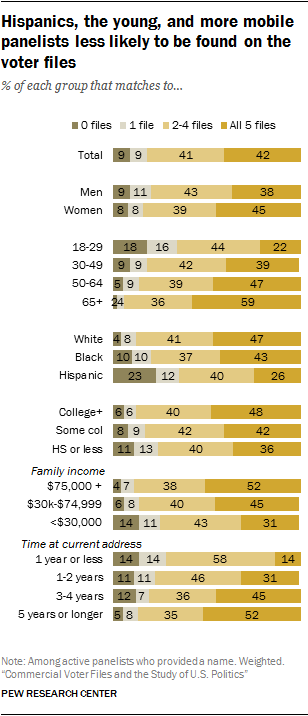

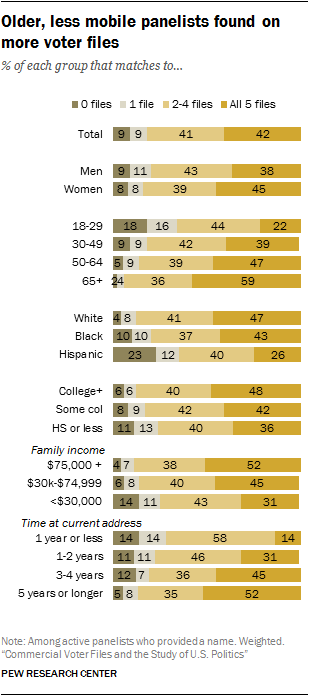

Still, commercial voter files may disproportionately miss segments of the public who are politically disengaged, younger, Hispanic and more mobile. Specifically, the likelihood of finding an individual on a commercial voter file was strongly related to whether they were registered to vote. On average across the five vendors, 77% of people who said they were registered to vote were matched. Only 38% of the self-described unregistered voters were matched. Similarly, match rates varied greatly by panelists’ age, race and ethnicity. Only about one-in-five younger panelists (22% of those ages 18 to 29) were found in all five files, as compared to more than half (59%) of older panelists (ages 65 and older). Similarly, just 26% of Hispanics were found in all five files, compared with 47% of non-Hispanic whites. 2 Mobility is also a strong correlate. Only 14% of those who reported moving in the last year were found on all five files. Those who reported living at their residence for longer matched at a much higher rate.

Still, commercial voter files may disproportionately miss segments of the public who are politically disengaged, younger, Hispanic and more mobile. Specifically, the likelihood of finding an individual on a commercial voter file was strongly related to whether they were registered to vote. On average across the five vendors, 77% of people who said they were registered to vote were matched. Only 38% of the self-described unregistered voters were matched. Similarly, match rates varied greatly by panelists’ age, race and ethnicity. Only about one-in-five younger panelists (22% of those ages 18 to 29) were found in all five files, as compared to more than half (59%) of older panelists (ages 65 and older). Similarly, just 26% of Hispanics were found in all five files, compared with 47% of non-Hispanic whites. 2 Mobility is also a strong correlate. Only 14% of those who reported moving in the last year were found on all five files. Those who reported living at their residence for longer matched at a much higher rate.

As a result of the systematic demographic differences in the types of people who were difficult to locate in the files, this analysis finds that commercial voter files may have significant limitations for efforts to study the general public (as opposed to registered voters). In comparison with random-digit-dial telephone samples, voter files do not provide the same degree of coverage of the adult population overall, and the kinds of people missed by the files may be very different politically and demographically from those who can be found in the files and contacted by phone.

The process of matching survey panelists to the voter files can be vexed by small differences in names and addresses, leading to ambiguity regarding the accuracy of some of the matches. In addition, difficulty with matching is related to lifestyle and demographic factors – such as frequently changing one’s residence – that are also correlated with political engagement and party preferences.

Across the five vendors there were significant differences in matching styles and, as a result, match rates. Some vendors restricted their matching only to panelists for whom they had a very high degree of certainty about the accuracy of the matches, resulting in an older and more politically engaged set of matched panelists. Other vendors assessed the trade-off differently and matched a higher share of panelists, producing a more diverse matched group while accepting more uncertainty about the accuracy of their matches.

The files generally agree with respect to voter turnout in the 2016 presidential election (at least among survey respondents who are matched in common), though one of the files appeared to miss a number of voters captured by the other four files. And there is no record of voting for nearly all survey respondents who said in a post-election survey that they did not vote in 2016.Among panelists who were matched by all the vendors in the study, 85% have identical turnout records across the five files: 75% are recorded as having voted in 2016 in all five files and 10% have no record of a vote in all five files. One file – File 3 – had records that conflicted with the other four files for many panelists, indicating that they may have missed the state voter records for many panelists.Another potential measure of data quality in measures of turnout is how closely the self-reported vote choice (e.g., Trump vs. Clinton) among those panelists flagged as having voted matched the actual election outcome. Reported presidential vote by panelists verified as having voted by at least one of the voter file vendors is very similar to the national vote share for each candidate (48% Clinton, 45% Trump among validated voters, compared with the official outcome of 48%-46%). Presidential vote among these validated voters was much closer to the outcome than the vote among all self-reported voters in the panel (49% Clinton, 43% Trump).

Self-reported data on voter registration status is particularly problematic. Many panelists who expressed doubt about their registration in a survey, or who said they were definitely not registered, nevertheless had a registration record on at least one file. This may reflect the fact that voter registration is an administrative status that is somewhat abstract rather than a more easily remembered behavior like voting.

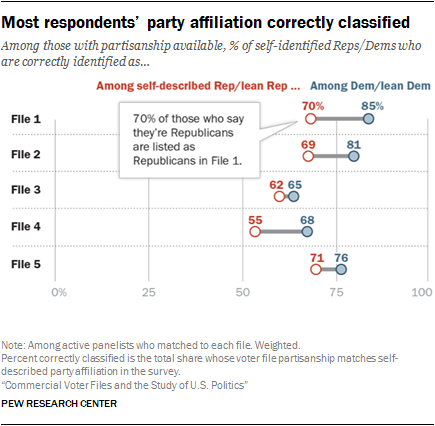

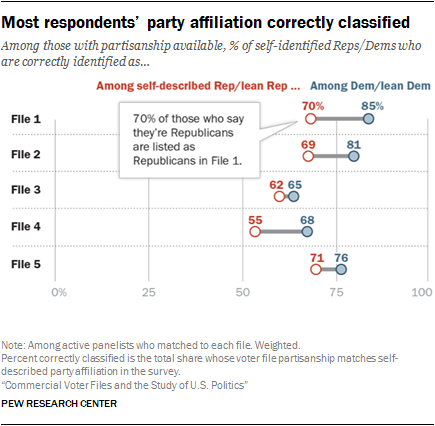

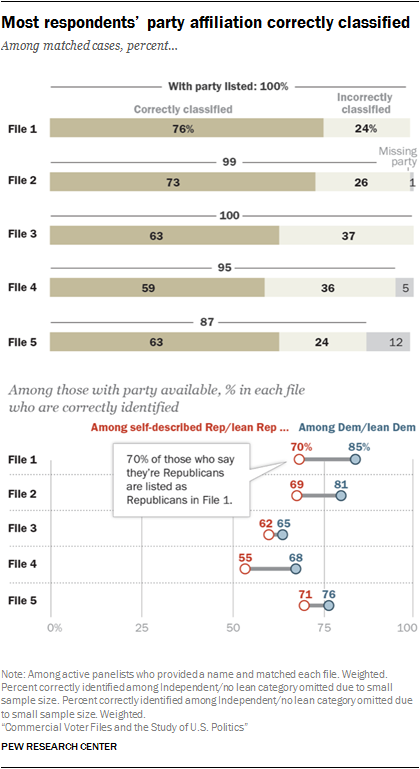

There was a relatively close correspondence between panelists’ self-reported party affiliation and the party identification predicted by voter file vendors. Voter file data on party affiliation benefits from the fact that many states register voters by party, and while voters’ party registration might not always match their self-identification, it is a very good proxy. However, even in states without party registration (roughly half of U.S. adults live in such states), the voter file estimates of party affiliation tended to be reasonably accurate. On average across the five files, modeled party affiliation in the files matched self-reported party affiliation for about two-thirds of panelists (67%). In general, the files did a better job of identifying Democrats than Republicans.

There was a relatively close correspondence between panelists’ self-reported party affiliation and the party identification predicted by voter file vendors. Voter file data on party affiliation benefits from the fact that many states register voters by party, and while voters’ party registration might not always match their self-identification, it is a very good proxy. However, even in states without party registration (roughly half of U.S. adults live in such states), the voter file estimates of party affiliation tended to be reasonably accurate. On average across the five files, modeled party affiliation in the files matched self-reported party affiliation for about two-thirds of panelists (67%). In general, the files did a better job of identifying Democrats than Republicans.

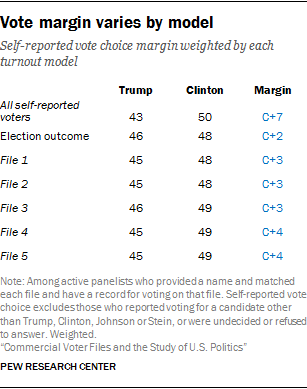

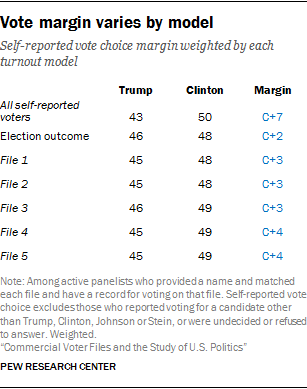

Voter file turnout models did a good job of predicting who would vote in 2016. The analysis in this report, along with a previous Pew Research Center study, show that using these scores to create a likely electorate for the 2016 general election improves election estimates relative to relying on self-reported information alone.Prior to the 2016 general election, each vendor provided a measure of turnout likelihood in the election, and applying these measures improved the accuracy of the American Trends Panel’s estimate of voter preferences in the presidential race. The estimate narrowed Hillary Clinton’s advantage from 7 percentage points among all registered voters to a range of 3 to 5 points using the modeled turnout scores. She ended up with a 2-point advantage over Donald Trump on Election Day. Past voter history is a key component of these models, but the exact algorithms the vendors use are not public.

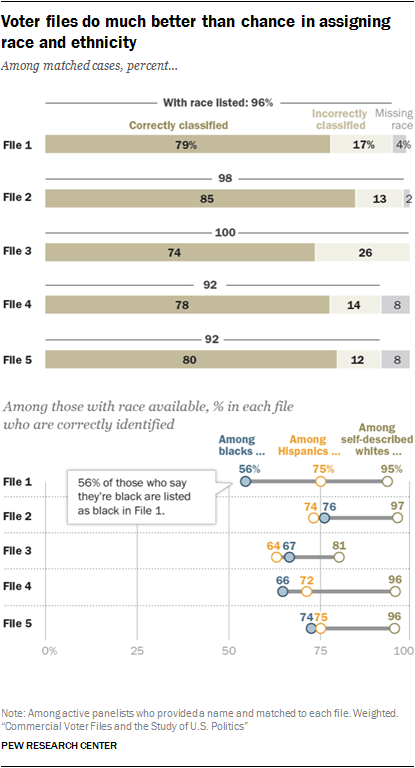

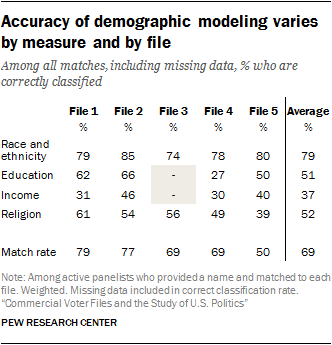

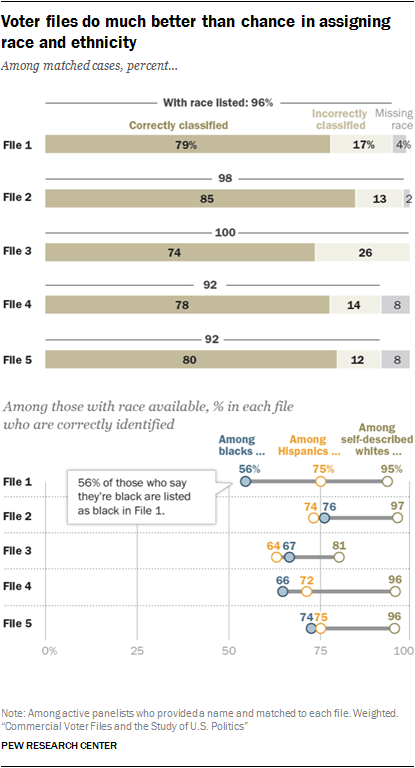

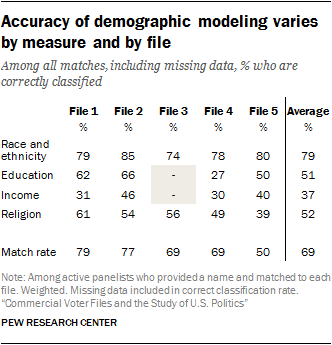

The voter file estimate of the race or ethnicity of panelists, when provided, also matched the survey data reasonably well. The files are able to accurately categorize 79% of panelists (on average) by race and ethnicity, including an average of 93% for non-Hispanic whites, 72% for Hispanics and 67% for blacks.

The voter file estimate of the race or ethnicity of panelists, when provided, also matched the survey data reasonably well. The files are able to accurately categorize 79% of panelists (on average) by race and ethnicity, including an average of 93% for non-Hispanic whites, 72% for Hispanics and 67% for blacks.

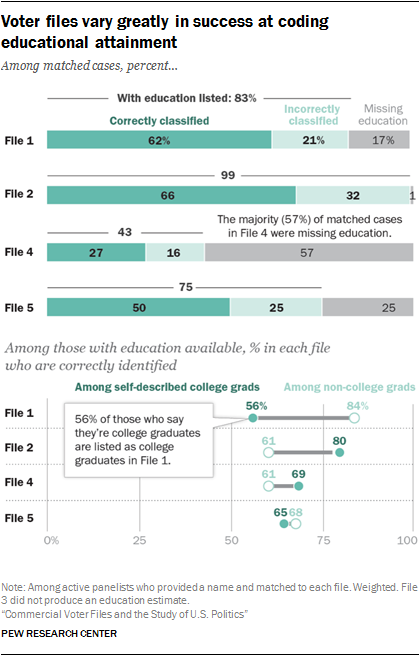

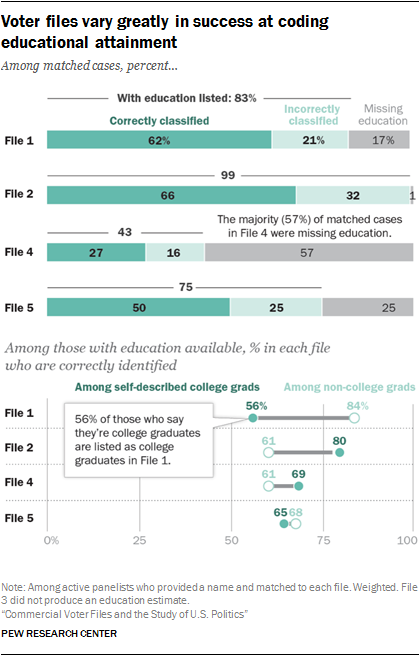

Other demographic data in the voter files – like education and income data – tended to be suggestive at best and were often missing entirely. The vendors differed considerably in the accuracy of some of these kinds of variables. Education level was either missing or inaccurate an average of 48% of the time across the files. Similarly, household income was missing or inaccurate 63% of the time on average across the files. In general, these demographic variables simply provide a greater likelihood of identifying a group of interest, rather than any certitude of doing so.

Caveats about the analysis

Because much of the analysis presented here is based on a comparison using data from Pew Research Center’s American Trends Panel, it is important to note that no survey, including the American Trends Panel, perfectly represents the adult population of the U.S. While data in the panel are weighted to be nationally representative with respect to a wide range of characteristics (age, sex, race, Hispanic origin, education, region of residence, population density etc.), no survey is an exact model of the population in all respects. A second caveat is that while most of the demographic information and partisan affiliation provided by the panelists is likely to be correct, self-reports of voter registration – or voter turnout, in particular – may err because of the phenomenon known as social desirability bias. Some individuals may report being registered or having voted when they have not. In general, self-reported demographic and related personal information about panelists will be treated as true, while self-reports of political engagement –behaviors that are viewed as socially desirable and are often overreported – will need to be evaluated carefully in light of the information in the voter files.

History of voter files

Election administration in the U.S. has historically been highly decentralized, with states adopting a range of methods for managing the election process and keeping records of who is eligible to vote and who has voted. This patchwork made it very difficult, if not impossible, to assemble anything resembling a national database of voters. Even statewide databases were unavailable in some places.

The relatively recent availability of commercial voter files is a result of both technological progress and government policy changes that resulted from problems in recent U.S. elections. The 2000 presidential election raised concerns about the accuracy, consistency and quality of election administration systems. In its aftermath, Congress adopted the Help America Vote Act of 2002 (HAVA) to address some of these issues. Among the many provisions of HAVA was that states were directed to create “a single, uniform, official, centralized, interactive computerized statewide voter registration list defined, maintained, and administered at the State level that contains the name and registration information of every legally registered voter in the State …”3 These digital databases then made it possible for partisan and commercial organizations to collect and compile national files of voters by combining the digital files from each state and the District of Columbia.

In an age when personal information has been increasingly commoditized, the files then iterated a step further. Very comprehensive databases of nearly all adults in the U.S. are now maintained by credit bureaus and other businesses. Commercial voter files based on registered voters can be compared with the larger databases of all adults to identify individuals who are not registered to vote. Records for these individuals are then added to the commercial voter files and all of the records are populated with additional political and nonpolitical information.

The compilation process that companies use to create the national voter files is far easier now than it was before HAVA, but it is not without its challenges. Americans remain a fairly mobile population, meaning that credit, consumer and voter files must be continually updated. A registered voter who moves to another state must re-register, and there is no uniform method by which election officials across states are notified when a voter moves. While both election officials and the commercial voter file vendors attempt to keep track of individuals when they move using resources such as the National Change of Address database from the U.S. Postal Service, the process is hardly foolproof. Each commercial vendor uses different methods for updating its files and making judgments about which official record associated with an individual is the most current one. Still, even with their flaws, the commercial voter files constitute a considerable improvement over what was available to campaigns, parties and researchers prior to the passage of HAVA.

Matching the American Trends Panel to voter files

In addition to their use as survey sample sources, voter files are commonly used in political research by matching and linking them to people who have responded to polls or are found in various lists such as members of the clergy or physicians. Efforts to link public vote records to surveys go back several decades prior to the existence of modern commercial voter files. In the 1980s, the American National Election Study attempted to link voter turnout records to its respondents by having interviewers visit local election offices where the respondents lived. This labor-intensive and expensive effort was later abandoned but has been revived with the availability of better quality digital files in individual states and the commercial files covering the entire country. The Cooperative Congressional Election Study is another prominent election survey that has matched respondents to a voter file.

The process of linking commercial voter file records to survey respondents (or any list, for that matter) might seem straightforward: Use the respondent’s name, address and other information to identify a voter file record for the same person. However, the matching process can falter if there are major differences in names (e.g., a maiden name vs. current married name), or addresses (e.g., if respondents have recently moved). Quirks in the data can also affect the matching process. And some individuals are simply not present in the commercial voter files at all. For uniformity, we accepted the data as the vendors sent it, knowing that for a variety of reasons (including those listed above), some vendors matched panelists that others did not.

To better understand and evaluate both the matching process and the properties of voter files, Pew Research Center attempted to match members of the American Trends Panel, its nationally representative survey panel, to five different commercial voter files. To be sure, there are more than five vendors that maintain comprehensive national voter lists, but the vendors used in this study represent five of the most prominent and commonly used voter files. Two of the files are from vendors that are traditionally nonpartisan, and three are from vendors that work primarily with clients on one side of the partisan spectrum – two that work with Democratic and politically progressive clients and one who works with Republican and politically conservative clients.4

To better understand and evaluate both the matching process and the properties of voter files, Pew Research Center attempted to match members of the American Trends Panel, its nationally representative survey panel, to five different commercial voter files. To be sure, there are more than five vendors that maintain comprehensive national voter lists, but the vendors used in this study represent five of the most prominent and commonly used voter files. Two of the files are from vendors that are traditionally nonpartisan, and three are from vendors that work primarily with clients on one side of the partisan spectrum – two that work with Democratic and politically progressive clients and one who works with Republican and politically conservative clients.4

All vendors were provided with the same panelist information: name, address, gender, phone number, race and ethnicity, date of birth and email address. They were asked to find these individuals in their voter files using their normal matching methodology and return the voter file records, such as registration status and turnout history, to Pew Research Center. Of the 3,985 active members5 of the ATP who provided a name6, 91% were identified in at least one of the five commercial voter files. Vendors agreed to delete personally identifying information about panelists when the matching was completed.

All vendors were provided with the same panelist information: name, address, gender, phone number, race and ethnicity, date of birth and email address. They were asked to find these individuals in their voter files using their normal matching methodology and return the voter file records, such as registration status and turnout history, to Pew Research Center. Of the 3,985 active members5 of the ATP who provided a name6, 91% were identified in at least one of the five commercial voter files. Vendors agreed to delete personally identifying information about panelists when the matching was completed.

When considered in total there is a high level of coverage of the survey panelists. But individual vendors matched at different rates. Two of the files (Files 1 and 2) matched the highest share of panelists (79% and 77% respectively) followed by Files 3 and 4 at 69% each.

File 5 matched at the lowest rate of just 50% of panelists. However, a low match rate does not necessarily imply lower quality data. In a follow-up analysis conducted to evaluate the quality of the matches, 99% of File 5’s matches were judged as likely accurate, compared with 94% to 97% of the other vendors’ matches. Voter file vendors told us that they have differing thresholds for confidence in selecting a match. This offers clients a trade-off in getting more data with more matches, at the cost of potentially including some inaccurate matches, versus fewer matches and greater accuracy but potentially more bias in the cases that are matched.7

Officials at File 5 said they were confident about the quality of their matches, which was borne out by our evaluation. However, they matched far fewer panelists than some other vendors and thus provided much less usable information overall, even if matches are limited to those who meet a high threshold of accuracy.

There is significant overlap in who matched to each file. Records for four-in-ten panelists (41%) were found on all five voter files and another 18% were found by four of the five vendors. Overall, 9% of panelists were found only on a single file – with most in this group coming from Files 1, 2 and 3). But each of the vendors found panelists that other vendors missed. Only 9% of panelists were not found by any of the vendors.

Matches made by File 5 (with the lowest overall match rate) have the highest overlap with other vendor matches. Fully 82% of matches to File 5 were also found by the four other files, followed closely by Files 3 and 4, with 60% of their matches being common matches with other files. Files 1 and 2 both had roughly half (53% and 54% respectively) of their matches found by all other files, with many of their matches found by only two or three other vendors.

How matches are made

The matching process uses information such as the respondent’s name, address, gender and date of birth – whether from a list or collected during the survey – to identify the respondent’s voter file record. Sometimes this process is straightforward, when a respondent’s name, address and date of birth match perfectly to the voter file. Unfortunately, this isn’t always the case. If the state voter list doesn’t report birthdays, or if a respondent is registered under a different name or at a different address, a successful match may not occur.

When a perfect match can’t be found, multiple possible matches must be considered, and the best match is chosen from among these. The process used by many vendors typically consists of two steps. The first step searches vast numbers of records to find potential matches, while the second chooses which among the plausible matches is best. At the first stage, the vendor’s matching software tries to identify all of the records that might be good matches to the respondent. Because the software has to sift through hundreds of millions of voter file records to identify these matches, computational shortcuts are used to locate plausible matches without burdening the software with assessing exactly which record will be the best match.

To give a concrete example, suppose that, at the time of this data collection, Vice President Joe Biden had been a part of our study. We would have asked the vendor to find the voter file record of a Joseph Biden, who reported being born in 1942 and residing (at the time) at 1 Observatory Circle, Washington, D.C., the official vice presidential residence. The software would set out to find all of the voter file records that could possibly refer to our respondent. People named Joe Biden or Joseph Biden, or having similar names like Jose Biden or Joe Widen, other 1 Observatory Circle residents and Bidens born in 1942 would all arise as possible matches. Once the full set of possible matches is generated by the first stage, the second stage begins. The software assigns all of the possible matches a score expressing the voter file record’s similarity to the respondent’s matching data. An exact name match would be assigned a higher score than approximate name matches like Jose Biden or Joe Widen. Similarly, matches that share a full birthdate or address would be assigned higher scores, while matches that merely live in the same city or that are the same age but have incomplete or nonmatching birthdates would receive lower scores. After all of these matching scores are generated, a best match is chosen.

Typically, the best match is simply the voter file record that mostly matches the information volunteered by the respondent. But other considerations can lead researchers to prefer a more imperfect match. Suppose we were left to choose between two records: a registered voter, Joseph Biden, with a listed home address in Wilmington, Delaware or a Joseph Biden, living at 1 Observatory Circle in Washington, D.C. but with no record of being registered to vote at that address. The Washington record is obviously the closer match, as it matches the address the respondent gave. On the other hand, if both records refer to the same Joseph Biden, then we may be more interested in the Delaware record, as the registered voter record will include information about his registration status, length of registration, vote history and political party. Ascertaining which of these two matches is preferred is partly a matter of making a trade-off between match confidence (the confidence we have that the record refers to the respondent) and the match’s usefulness (the amount of useful and relevant data conveyed by the voter file record).

When researchers have to match survey data to the voter file, they face the choice of doing the matching themselves. They can either take the whole voter file (or large portions of it) and write computer code to find the records that best correspond to the survey respondent, or they can opt to have a voter file vendor do it for them. Having a vendor do the matching is appealing, since it requires less work from the researcher and it can even be less expensive, since it means purchasing less data from a voter file vendor, but it comes at the cost of having less control over the matching process. When contracting out the matching process to a vendor, researchers typically never see the rejected matches, making it difficult to assess whether better matches were erroneously rejected by the vendor.

On the other hand, vendors have more experience matching and can usually devote more computational and software engineering resources to the problem than researchers can. Even if the methods are proprietary and not especially transparent, they could be a preferable option if their performance is superior.

Biases in the match

Failures to match do not occur randomly. Rather, certain kinds of people are less likely to be successfully matched. These individuals also tend to be different politically than those who are easier to match. This can lead to biases in conclusions drawn from data with matched voter file information. Panelists who are registered to vote and say they participate regularly in elections are more likely to be matched, leaving the politically disengaged underrepresented in voter files. This is to be expected, as registered voter lists in the states make up the bedrock of voter files.

Failures to match do not occur randomly. Rather, certain kinds of people are less likely to be successfully matched. These individuals also tend to be different politically than those who are easier to match. This can lead to biases in conclusions drawn from data with matched voter file information. Panelists who are registered to vote and say they participate regularly in elections are more likely to be matched, leaving the politically disengaged underrepresented in voter files. This is to be expected, as registered voter lists in the states make up the bedrock of voter files.

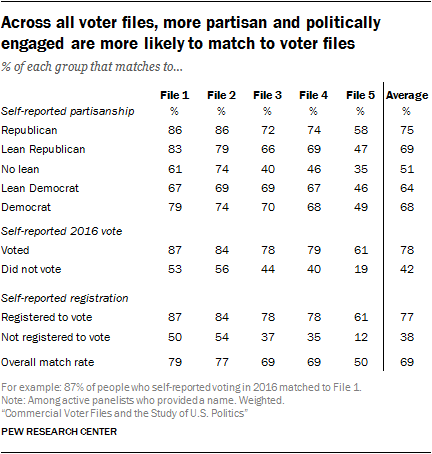

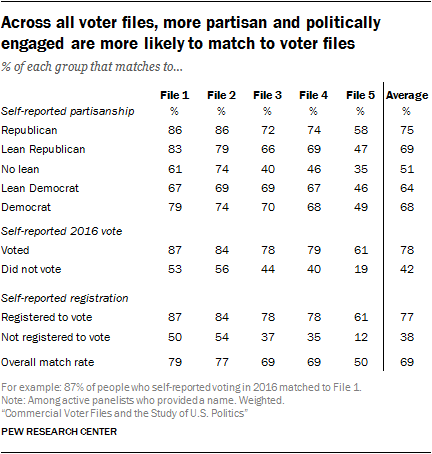

In particular, Files 1 and 2 match more of those who are not politically active and engaged than the other vendors. Just 19% of those who said they didn’t vote in 2016 were matched to File 5. By comparison, 56% of 2016 nonvoters matched to File 2 and 53% were matched by File 1. A similar pattern emerges with voter registration. While File 2 matches 54% of those who say they’re not registered to vote, File 4 matches only about one-third (35%) of that group to their file, and File 5 – with the lowest overall match rate – matched only 12%.

A similar pattern appears with respect to party affiliation. Files with higher match rates, such as File 1, were able to match eight-in-ten or more of those who identify with a party to their file (86% of Republicans and 79% of Democrats), while 61% of those who do not lean toward either party were matched. While Republicans have a slightly higher match rate in several files, the partisan differences are modest.

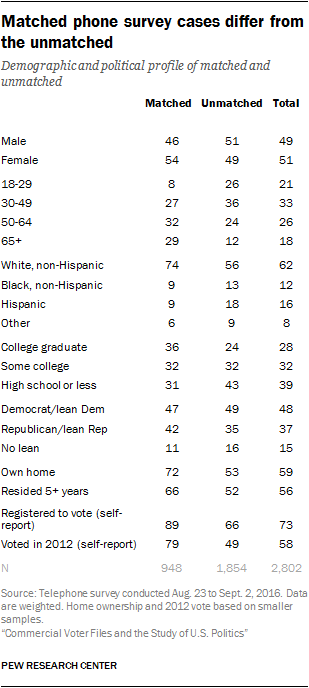

Differences in the match rates for different subgroups naturally have an impact on the demographic and political composition of those matched. While all files have a political engagement bias in terms of who is matched, those biases increase as match rates decrease. In other words, as vendors become stricter in terms of who they consider a match, the sample of people who are matched looks increasingly politically engaged. For example, 75% of American Trends Panel members say they voted in the 2016 election. Among those matched to File 1, the file with the highest match rate, 83% report having voted in 2016. Among those matched to File 5, the file with the lowest match rate, 90% report having voted.

Differences in the match rates for different subgroups naturally have an impact on the demographic and political composition of those matched. While all files have a political engagement bias in terms of who is matched, those biases increase as match rates decrease. In other words, as vendors become stricter in terms of who they consider a match, the sample of people who are matched looks increasingly politically engaged. For example, 75% of American Trends Panel members say they voted in the 2016 election. Among those matched to File 1, the file with the highest match rate, 83% report having voted in 2016. Among those matched to File 5, the file with the lowest match rate, 90% report having voted.

Interestingly, these differences are not present when it comes to partisanship. While the partisan composition of the panelists matched to each of the five files is slightly more Republican than the panel overall, differences among the files are minor or negligible.

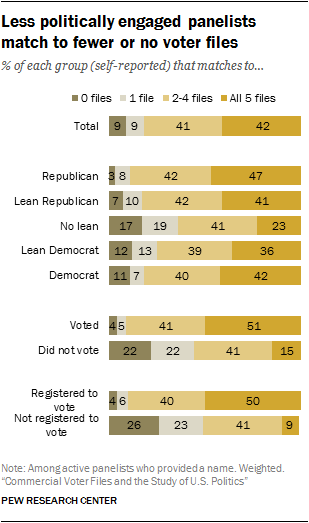

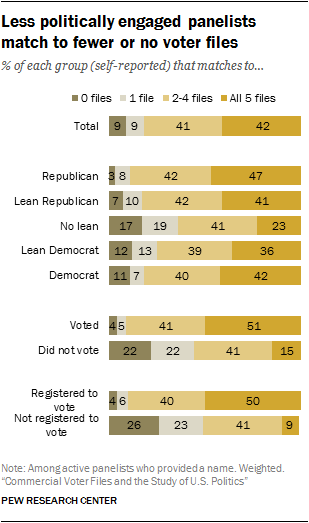

A consequence of these differences in match rates by partisanship and political engagement is that panelists who are registered to vote and regularly participate in elections are more likely to be matched to multiple files, while those who do not participate tend to be found on fewer (or no) files. Nearly two-in-ten who self-report not leaning toward either party (17%) are not able to be matched to any of the five voter files compared with just 3% of those who identify as Republican. Democrats and independents who lean Democratic are also slightly less likely to match: 11% of Democrats and 12% of Democratic leaners were not matched to any files.

By the same token, those who identify with either of the parties are far more likely to be found in many, if not all, of the voter files in this study – a reasonable proxy for being easy to find. While just 23% of those who do not lean toward either party were found in all five files, more than four-in-ten Republican identifiers (47%) and Democratic identifiers (42%) were found on all five files. Those who lean toward either party, regardless of partisanship, were a little less likely to match across the files: Only 41% of Republican leaners and 36% of Democratic leaners matched to all five files.

By the same token, those who identify with either of the parties are far more likely to be found in many, if not all, of the voter files in this study – a reasonable proxy for being easy to find. While just 23% of those who do not lean toward either party were found in all five files, more than four-in-ten Republican identifiers (47%) and Democratic identifiers (42%) were found on all five files. Those who lean toward either party, regardless of partisanship, were a little less likely to match across the files: Only 41% of Republican leaners and 36% of Democratic leaners matched to all five files.

An even more dramatic pattern can be seen with political participation. Half (51%) of those who reported voting in the 2016 election matched to all five voter files, compared with just 15% of those who said they did not vote. More than four-in-ten (44%) of those who said they didn’t vote were found in just one or no voter files, vs. 9% of those who said they voted. Among panelists who report not being registered to vote, 26% are not found on any voter files and another 23% match to only one file. Just 9% match to all five voter files.

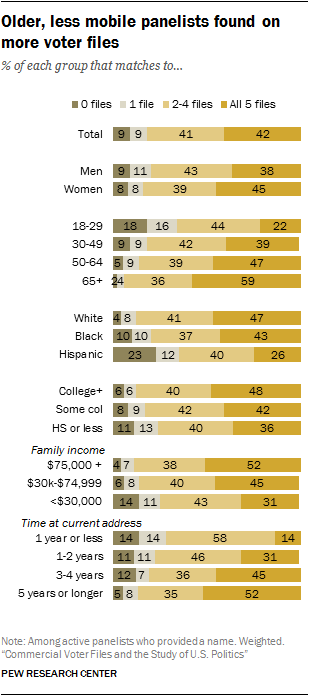

Beyond the impact of political engagement, certain demographic characteristics are strongly associated with propensity to match. Voter files tend to do a better job of matching older, white, less mobile panelists while younger, more diverse and more mobile panelists end up with fewer or no matches. And, of course, these demographic characteristics are related to both partisanship and likelihood of participating in politics.

Age and mobility are particularly strongly associated with matching. Across all of the vendors, there is a roughly 30-point difference in the rate of matches between people ages 18-29 and those 65 and older. Similarly, people who have lived at their current address for less than one year are considerably less likely to be matched than those who have resided at their address for at least five years.

As a consequence of these patterns, the demographic profile of those matched differs somewhat across the vendors. File 5, with the lowest match rate, has the smallest share of panelists ages 18-29 (13% vs. at least 16% for the other files). And two-thirds of File 5’s panelists have lived at their current residence for at least five years, compared with 58% to 59% for the other vendors.

The demographic differences in propensity to match also mean that more than one-in-six younger panelists (18% of those ages 18-29) are not matched to any of the five files and an additional 16% were found on just one file. Only 22% of younger panelists were found in all five files. By comparison, 59% of older panelists (ages 65 and older) were found on all five files, and just 2% were not found on any of the files. Similarly, 52% of those who have lived at their current address for five or more years matched to all five files and just 5% could not be located in any file. Just 14% of those with less than one-year tenure at their current address were located by all five files.

Hispanics match at lower rates than other racial or ethnic groups. Nearly a quarter (23%) are not matched to any files. Only 26% of Hispanics were matched by all five files, while nearly half (47%) of whites were found by all five. Blacks fall somewhere in between. Roughly four-in-ten blacks (43%) were found on all five files, while 10% were not matched to any files.

While there are differences in propensity to match by educational attainment, they are comparatively minor. Half (48%) of panelists who report having at least a bachelor’s degree were matched to all five files, compared with 36% of those who reported having a high school diploma or less. Panelists at all education levels are roughly equally likely to not be matched to any file.

How well do the voter files cover the unregistered?

When voter files first came to prominence for practitioners and researchers, many were just what the name suggests – lists of registered voters. However, as research and targeting using the voter files has become more widespread, most vendors try to provide coverage of all U.S. adults, including those not registered to vote, in their files. Because the core component of the files is a combination of official state lists of registered voters, vendors have sought out commercial databases – available from sources such as credit rating agencies – to locate Americans missing from state voter rolls.

How well the files cover the unregistered population is potentially an important consideration for those who wish to use the files to locate and attempt to persuade the unregistered to register. Coverage of the unregistered is also important if the file is to be used for describing or conducting surveys of the general public and not just voters. To date, pollsters have used the files as a source for sampling the registered voter population, but files that make an effort to cover the full population could theoretically have utility as sampling sources for the general public. To the extent that they accurately represent the non-registered population, such files provide the researcher with the opportunity to use information in the files to guide the sampling. For example, the non-registered and registered voters with lower turnout propensities could be oversampled for research aimed at understanding the less engaged.

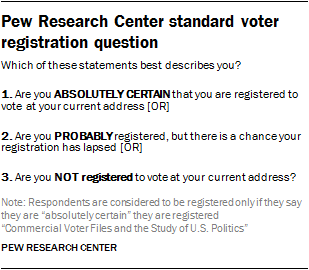

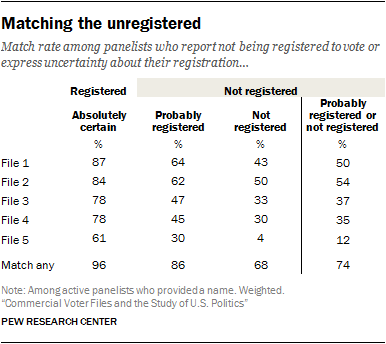

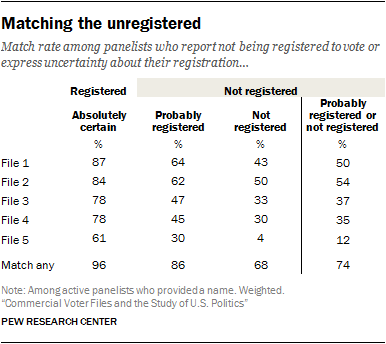

To assess how well the files cover the unregistered, the match rates and composition of the matched cases was compared for panelists who report being registered to vote and for those who say they are not registered or are not sure if they are registered. In Pew Research Center surveys, respondents are considered unregistered if they report not being registered or express uncertainty about their registration. Among members of the American Trends Panel, those considered unregistered are much less likely to have been matched by the files. As noted in the previous chapter on the matching process, the match rates for the self-reported unregistered varied from a low of 12% to a high of 54%, depending on the vendor. Not surprisingly, panelists who were certain about their lack of registration had the lowest rates, ranging from 4% to 50% matched, with those who said they were probably registered but not certain falling between the certainly registered and the certainly unregistered.

To assess how well the files cover the unregistered, the match rates and composition of the matched cases was compared for panelists who report being registered to vote and for those who say they are not registered or are not sure if they are registered. In Pew Research Center surveys, respondents are considered unregistered if they report not being registered or express uncertainty about their registration. Among members of the American Trends Panel, those considered unregistered are much less likely to have been matched by the files. As noted in the previous chapter on the matching process, the match rates for the self-reported unregistered varied from a low of 12% to a high of 54%, depending on the vendor. Not surprisingly, panelists who were certain about their lack of registration had the lowest rates, ranging from 4% to 50% matched, with those who said they were probably registered but not certain falling between the certainly registered and the certainly unregistered.

The files collectively found far more of the unregistered than did any single file by itself. Two-thirds of those who were certain that they were not registered were located by at least one of the files, while 86% of those who said they were probably registered were matched. More than nine-in-ten (96%) of the certainly registered group were found in at least one file. But differences in match rates across the files were much greater for people in the two unregistered categories than for those who were certain they are registered.

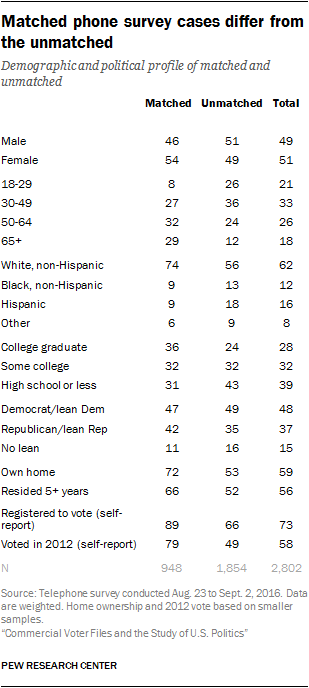

The collective results of the five files provide evidence that the unregistered are not completely invisible to commercial files of the sort examined in this study. This is reinforced when comparing the demographic and political profiles of the registered and the unregistered.

The collective results of the five files provide evidence that the unregistered are not completely invisible to commercial files of the sort examined in this study. This is reinforced when comparing the demographic and political profiles of the registered and the unregistered.

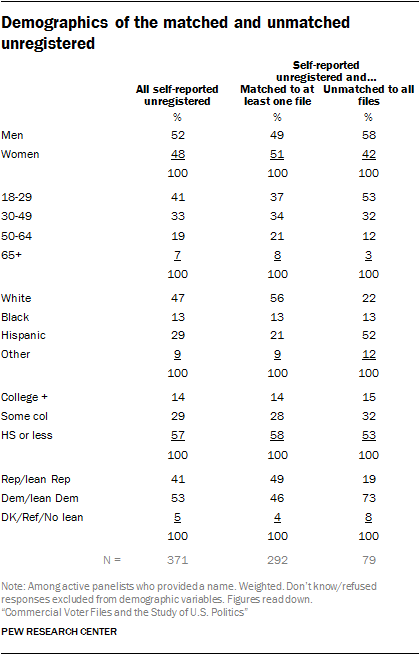

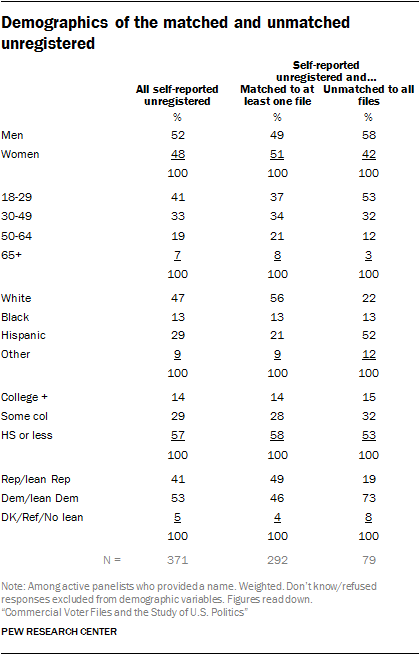

As a group, the matched unregistered are similar to all unregistered, perhaps somewhat unsurprisingly since they constitute about three-quarters of the latter group. One difference that stands out is that the matched unregistered are significantly more likely to identify as Republican or Republican-leaning than are all unregistered panelists (and twice as likely to be Republican as the unmatched unregistered). This anomaly is evident in the collective group (matched to any file), as well as in each of the individual voter files. Research suggests it could be linked to the fact that those who are matched and unregistered tend to be wealthier than the unmatched.

Although the files collectively cover a sizable share of the unregistered, the unregistered population who are unmatched to any of the files are quite different with respect to age, race and partisanship. Just over half (53%) of the unmatched unregistered are younger than 30, compared with 37% among those matched to at least one file (and 21% among all adults). Half of the unmatched unregistered (52%) identify as Hispanic, compared with just 21% among the matched cases. And just two-in-ten (19%) of the unmatched unregistered identify as Republican or Republican-leaning, compared with 41% of all unregistered.

Although the files collectively cover a sizable share of the unregistered, the unregistered population who are unmatched to any of the files are quite different with respect to age, race and partisanship. Just over half (53%) of the unmatched unregistered are younger than 30, compared with 37% among those matched to at least one file (and 21% among all adults). Half of the unmatched unregistered (52%) identify as Hispanic, compared with just 21% among the matched cases. And just two-in-ten (19%) of the unmatched unregistered identify as Republican or Republican-leaning, compared with 41% of all unregistered.

Collectively, these results show that, especially within a group known to be harder to match (the unregistered), there are demographic biases in the unmatched. These biases largely echo what we see in matching among the general public.

Political data in voter files

Among the most important data on the voter files for the election analyst are the records for whether or not someone is registered to vote and whether they voted in a given election. These individual registration and turnout records come directly from records kept by each state for every election. The turnout record indicates whether or not someone voted in a given election, though it does not provide their chosen candidate or party. The registration record may include which political party the individual is registered with (in states where voters can register by party). When combined with other data in the voter file, it is possible to create a rich picture of who is registered and who showed up to vote in previous elections.

In addition, while an individual’s vote history is readily available through the official voter records in all 50 states and the District of Columbia, commercial voter files typically offer scores for things like partisanship and expected turnout for future elections generated through predictive models. This chapter will explore the availability and accuracy of political data on voter files, both raw and modeled.

Vote history is largely consistent across the files

Election analysts greatly value the availability of turnout records for past elections. Being able to document turnout in different types of elections (e.g., presidential years and off-years) enables researchers to better understand how voters differ in motivation and resources to participate. It is, of course, possible to ask survey respondents about voting in past elections. But pollsters recognize that memories about events that occurred two or four years ago (or longer) are potentially faulty, especially for respondents who are not especially interested in politics. Thus, having accurate turnout records for individuals is an important asset of the commercial voter files. Even with direct access to state voter files, a researcher may not be able to document an individual’s past voting behavior if they have changed their state of residence during the period of interest.

Election analysts greatly value the availability of turnout records for past elections. Being able to document turnout in different types of elections (e.g., presidential years and off-years) enables researchers to better understand how voters differ in motivation and resources to participate. It is, of course, possible to ask survey respondents about voting in past elections. But pollsters recognize that memories about events that occurred two or four years ago (or longer) are potentially faulty, especially for respondents who are not especially interested in politics. Thus, having accurate turnout records for individuals is an important asset of the commercial voter files. Even with direct access to state voter files, a researcher may not be able to document an individual’s past voting behavior if they have changed their state of residence during the period of interest.

One important caveat to consider with vote history is that, while the presence of a record of voting almost certainly means that a person voted in that election, the absence of a record doesn’t mean they definitely did not vote. The lack of a record could indicate that someone did not vote, that the matched data has missed one or more election records for an individual or even that the match is to the wrong person. Even when the match is to the correct person, the voter record attached to that person in the commercial file may be out of date or otherwise incorrect.

The situation is even more ambiguous for individuals who are not matched to a voter file. Since voter files are built on a base of official state records and subsequently expanded with non-official commercial records, the absence of a match may indicate that the individual does not have a state registration or voter record where he or she currently lives. This could imply that he or she is not registered and therefore probably did not vote in recent elections. But this cannot be said for sure, since failures to match can occur even when a state record exists (for reasons discussed earlier).

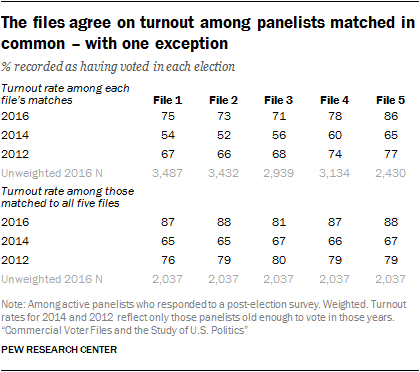

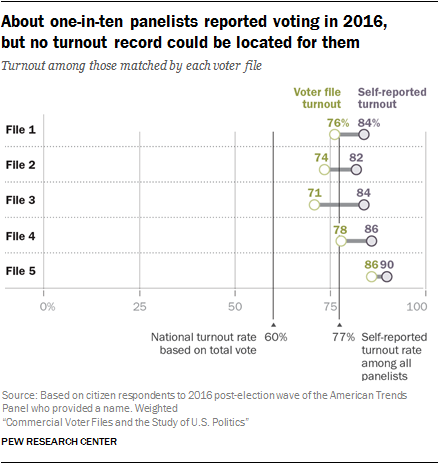

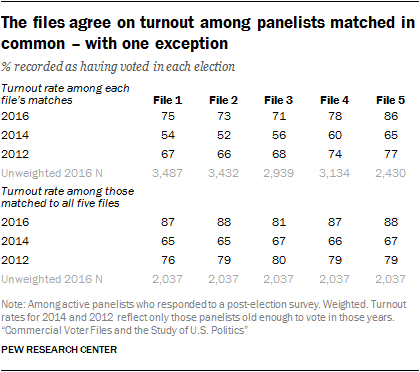

In assessing turnout for the 2016 presidential election, there tends to be a fairly high degree of agreement among the files on an individual’s vote history. This is likely because all the vendors draw from the same state voter files as raw source material. This is especially the case for four of the five files, which produce relatively similar turnout rates. Estimates in File 1 through File 4 range from a low of 71% who are listed as having voted in 2016 to a high of 78%. However, File 5 exists as an outlier. As the file with the lowest match rate, File 5 produces the highest estimate for turnout in 2016, at 86%. While these turnout rates are in line with self-reported turnout on the American Trends Panel, the turnout rates here are considerably higher than the known turnout rate in each election. However, as noted in Chapter 2, politically engaged respondents are more likely than less engaged respondents to be matched to the voter files. This leads to higher estimates for turnout in each election.

To eliminate the variation in turnout rates produced by differences in match rates across vendors, the turnout rates were computed for the roughly four-in-ten (42%) panelists who were matched by all five files. Among these panelists, 85% have identical turnout records across the five files (75% are recorded as having voted in all five and 10% have no record of a vote in all five). At the aggregate level, turnout was 87% to 88% in four of the five files, but is 7 points lower in File 3 (81% turnout). The reason for this exception is unclear.

As with turnout in 2016, the vendors vary somewhat in their rates of voting for 2012 and 2014. However, when restricting to the common set of matches between all five vendors, most of the variability is eliminated (as it was for 2016): Turnout estimates for 2014 vary between 65% and 67%, and for 2012, between 76% and 80%. In this analysis, File 3 does not stand out as exceptional, as it did with the 2016 vote.8

The fact that turnout rates for 2012 are considerably lower than for 2016 illustrates the difficulty of accurately tracking voting records over time, even for organizations that have made it a very high priority to do so. The actual turnout rate among voting-eligible adults for 2016 is estimated at 60%, while the 2012 rate is just 1 point lower (59%). And yet, the 2016 turnout rate for the panelists exceeded the 2012 rate by margins of 3 to 9 points across the five files. It is clear that vote histories get lost as people move or change names, despite the best efforts of vendors to build a complete history for those in its files.

Survey error in reported turnout

One of the most common challenges facing survey research about elections is the tendency for some people to say they voted when they did not. This phenomenon has received extensive academic attention, and much of the research has relied upon surveys matched with validated voter turnout data. For many people, voting is a socially desirable behavior because it conforms to traditional notions of civic duty. Accordingly, there may be pressure for people to claim they voted even when they did not. Previous research has documented that the incidence of misreporting turnout is higher among people who value political participation and, as a group, may already have higher rates of turnout. Voter files have greatly aided researchers’ understanding of error in the measurement of voter turnout.

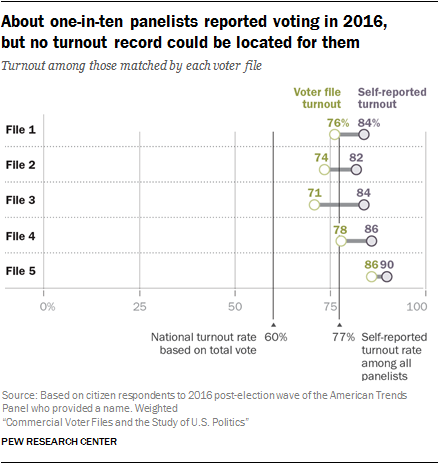

As expected, the rate of self-reported turnout in 2016 exceeded the voter file estimates among matched panelists in all five voter files. The overestimate of turnout ranged from 4 percentage points in File 5 to 13 points in File 3.

As expected, the rate of self-reported turnout in 2016 exceeded the voter file estimates among matched panelists in all five voter files. The overestimate of turnout ranged from 4 percentage points in File 5 to 13 points in File 3.

Yet unlike most studies that have examined overreporting of voting, which typically use a single source of voter validation, Pew Research Center has five sources for evidence of turnout and thus can be more confident that failures to match or errors in record-keeping by a single source might lead to erroneous conclusions about an individual’s turnout. If researchers are confident of the accuracy of the matches for an individual, a record in one file that they voted is strong evidence even if other files provide no record of voting.

Panelists were interviewed shortly after the 2016 election about their participation in the election and asked whether and for whom they voted. The self-reported turnout rate among panelists (restricted to citizens) was 77% (weighted) – 17 percentage points higher than the estimated turnout rate among the entire voting-eligible population.

This overestimate of turnout is likely a consequence of three different factors. One is (as discussed above) misreporting by respondents, driven by the desire to appear more engaged or perhaps by a respondent’s impression of one’s self as a dutiful citizen who usually votes. Another is that the survey’s sample includes people who are more politically engaged than the typical American. The third is that being surveyed, and especially being in a panel with regular surveys, might stimulate a respondent’s interest in politics and potentially motivate them to vote. Warren Miller, a renowned political scientist who was a coauthor of the seminal research on elections, “The American Voter,” once said that the American National Election Study was “the most expensive voter mobilization project in American history” because it appeared to have motivated many of its respondents to vote when they might otherwise have not done so.

The voter files provide excellent evidence about the first of these explanations – misreporting by respondents. Self-reports of turnout can be compared with the verified record of voting to estimate the extent of overreporting and the characteristics of those who overreport. To do this, researchers used a composite estimate of turnout based on records in all five files. If any file included a record of turnout for the panelist, it was assumed that the panelist voted, even if other files did not find a voter record. If a matched panelist had no record of voting in any file, that person was considered a nonvoter. But because there were five vendors looking for panelists, researchers made the additional assumption that unmatched panelists were also nonvoters. The validity of this assumption depends on the accuracy of the matches. Consequently, before implementing this step, researchers evaluated the quality of the matches by comparing the name and address of each panelist with the name and address on the voter file record that matched to it. Matches judged to be possibly incorrect because of inconsistencies in the name or address were considered unmatched for purposes of this analysis.9

To review, if any file included a record of turnout for the panelist, it was assumed that the panelist voted, even if other files did not find a voter record. All other panelists were considered to be nonvoters. This is based on the fairly strong assumption that panelists who could not be located and verified as a voter in any official voter file by five different commercial vendors can be assumed to have not voted.

Using this approach, the voter file verified turnout rate among the panelists was 65%, 5 percentage points higher than the best estimate of national turnout among eligible adults. One percent among the 65% are panelists who said they didn’t vote but have a record of doing so. This small group of fewer than 20 individuals may have accidentally selected the wrong option on the survey, or there could be an error in the official turnout record. About one-in-five panelists (22%) are validated nonvoters (respondents who said they didn’t vote and for whom no record of voting exists).

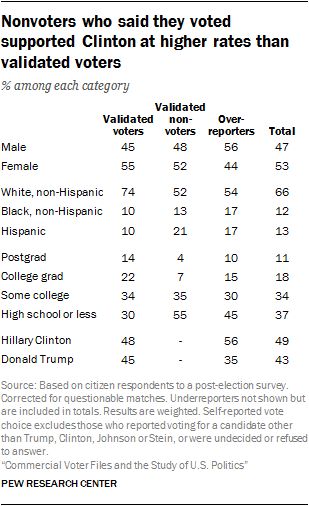

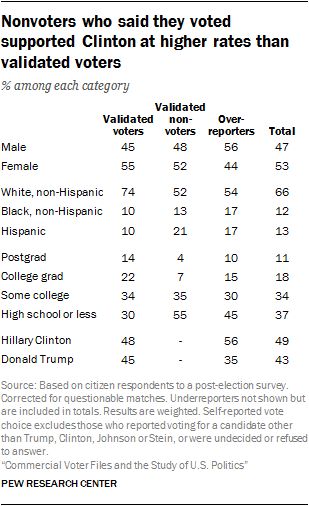

The remaining group consists of the overreporters. These are the 12% of all voting-eligible adults (citizens who are 18 years of age or older) who said they voted but for whom no record can be located across five voter files. Demographically, these individuals are more male than female (56%-44%), disproportionately black and Hispanic (17% each, compared with about 10% each among validated voters), much more Democratic than Republican in party affiliation and more supportive of Hillary Clinton than Donald Trump (56% Clinton, 35% Trump vs. 48% to 45% among verified voters). They are much more likely than validated nonvoters to say they “always” vote (44% vs. 5%) and that they follow what’s going on in government and politics most of the time (36% vs. 13%).10

Having a validated measure of who voted and who did not makes it possible to assemble a more authoritative portrait of the electorate in 2016. As post-election analysis has demonstrated, the composition of the 2016 electorate is important in understanding Donald Trump’s 2016 election victory, and – more broadly – what kinds of changes may be occurring in the U.S. political system.

Analysts have generally relied upon three main sources of data on who votes. One is the National Election Pool’s (NEP) exit poll, which provides estimates of the voting patterns among different groups in the population. Another is the U.S. Census’ Current Population Survey (CPS) supplement on voter registration and turnout, conducted shortly after the general election. A third is the set of independent surveys such as the American Trends Panel and the American National Election Study.

The NEP’s exit poll has been criticized for overrepresenting younger, college educated individuals and minorities. The CPS survey finds an electorate that is less educated and more likely to be white, as do many independent surveys.

The American Trends Panelists who self-identify as having voted in 2016 looks very much like the CPS electorate, especially with respect to the critical category of non-college whites. The ATP sample of self-reported voters is 43% non-college white, about the same as in the CPS survey, and just 34% in the exit poll. But the ATP self-reported voters supported Hillary Clinton by a six point margin, 49% to 43%. Restricting the sample to those who are validated as having voted in at least one of the voter files does not change the composition of the sample very much (though the share of white non-Hispanic voters rises from 71% to 74%), but the vote margin now approximates the actual election result, 48% Clinton to 46% Trump.

Using just the matches in each of the voter files produces similar results with respect to the horse race. Compared with reported vote choice among all matched panelists in each file who said they voted, the Clinton advantage over Trump among validated voters in each file was narrower. Clinton’s advantage varies from 2 to 4 points across the five files (versus 3 to 6 points among all self-reported voters matched by in each file).

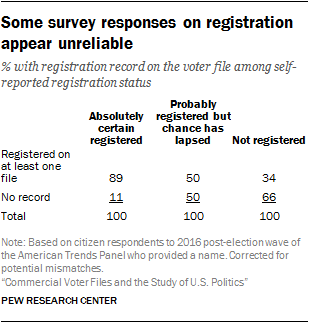

Self-reported voter registration status is murkier than voter turnout

Compared with voter turnout, voter registration is a much more problematic measurement issue for survey researchers. The fact that voter registration is a status rather than an activity means it is something that can be difficult to remember accurately. For one, the typical person registers to vote much less often than they turn out to vote. For people who vote rarely or never, their registration is largely an abstraction – an administrative status maintained by their state’s election authority without input from the individual. If someone registered to vote nine years ago but hasn’t voted in five, are they still registered to vote? Without a call to the local election office, it would be hard for them to know.

In addition, there are a number of different ways states handle their voter registration databases. For example, states periodically clean voter registration data, either because someone is believed to have moved or they have not voted over a period of time. So if a voter stays at the same address for many years and is able to maintain their registration, either through periodic voting or because their state allows registrants to remain on the file without voting or confirming their continued residence, their most recent act of registration is long in their past. This adds a source of error for voters answering questions about their registration in that they may simply not know with certainty if they are registered.

The abstraction of voter registration in a survey respondent’s mind, however, does not mean that his or her voter registration cannot be validated. If a state voter file contains a record of the respondent at their current address, then the respondent is definitely registered to vote. After all, the state voter file is the authoritative source of data used on Election Day to check in voters.

Ambiguities occur when a voter claims to be registered but no record matching their current address can be found on the voter file. The lack of a matching record is not proof that the person is not registered. In some localities, voters who have moved can vote as long as they haven’t changed voting districts. Others may choose to vote in their old precinct, using the registration attached to their previous address. College students are able to vote in some states where they attend school, but that may not reflect their permanent address.

Another possibility for why voters who report being registered do not have a corresponding record is that the respondent was not able to be matched to the commercial voter file at all. This could be due either to errors on the voter file or in the personally identifying data provided by the respondent, preventing an otherwise valid registration from being found. In light of these possibilities, care should be taken when assessing the registration status of seemingly unregistered respondents.

Survey error in reported registration

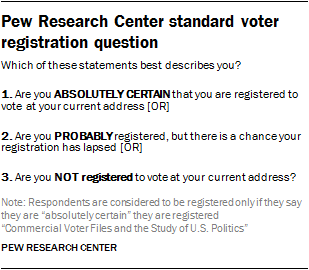

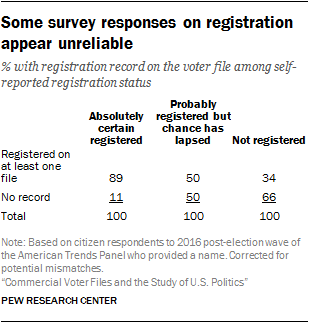

The problematic nature of measuring voter registration is evident in the mismatch between the voter file data and responses from the American Trends Panel participants. Panelists are asked periodically about their registration status using the three-category question described earlier in the report. Survey responses about registration were compared with registration status from the voter files. For the purpose of this analysis, due to the complicated nature of voter registration as discussed above, survey respondents with possibly incorrect matches were flagged as unregistered, unless a valid registration record was located on at least one other file.

A registration record was located on at least one matched voter file for 89% of panelists who expressed certainty that they are registered. Half (50%) of those who were uncertain about their status (and who are considered unregistered in our normal survey protocol) had a registration record on at least one file. Even 34% of those who said that they are not registered had a registration record on at least one of the files.

A registration record was located on at least one matched voter file for 89% of panelists who expressed certainty that they are registered. Half (50%) of those who were uncertain about their status (and who are considered unregistered in our normal survey protocol) had a registration record on at least one file. Even 34% of those who said that they are not registered had a registration record on at least one of the files.

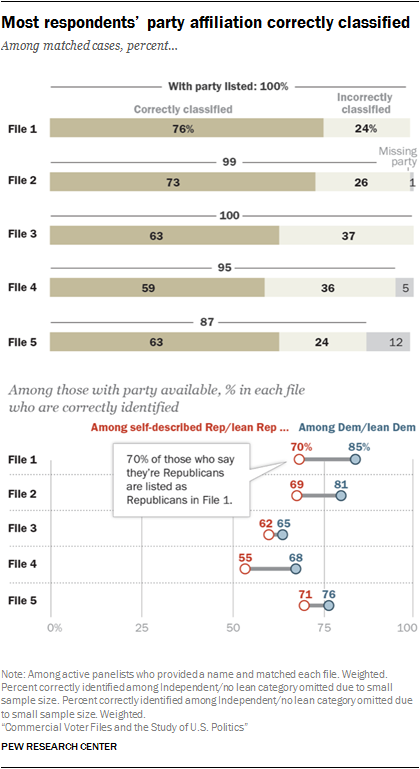

Because some official registration records themselves may be out of date, the survey measure may not be as problematic as it appears here. For example, someone who has moved may have a valid registration record at a previous address – perhaps the source of the voter file match – but be unsure as to whether they are registered at their current address. But it is clear that registration status is a murkier concept to capture in a survey.

Modeled partisanship is correct for a majority of cases

There are traditionally two types of partisanship classifications available in voter files. The first is party registration. However, since this is not available in all states, voter file vendors attempt to model partisanship based on demographics, voter turnout and other factors. While each of these models is different, four vendors provided a modeled score that ranges from 0 to 100, where 0 is most Republican and 100 is most Democratic. One vendor, however, simply categorized panelists by party.

In all, files that provided a modeled 0 to 100 score did a better job of correctly classifying the partisan affiliation of panelists against their self-reported partisanship. In particular, Files 1 and 2 performed relatively well at correctly classifying voters (76% and 73% correctly classified respectively). File 4 had the lowest share of panelists correctly classified (59%), due in part to a higher than average share classified as independent in this model. Two-in-ten American Trends Panel members (20%) matched to File 4 are classified as politically independent, compared with just 3% who self-identify as not leaning towards either party.

In general, all of the files were able to identify Democrats at a higher rate than Republicans. But three vendors stood out in this regard. File 1 correctly identified 85% of Democrats and 70% of Republicans, while File 2 correctly identified 81% of Democrats and 69% of Republicans. And while File 4 had lower rates of accurate identification overall, it, too, was better able to identify Democrats (68% correctly identified) than Republicans (55% correct). The fact that a large majority of blacks identify as or lean Democratic contributes to the higher accuracy rate for Democrats than Republicans.

Modeled turnout scores improve the accuracy of election estimates

Predicted voter turnout is one of the most commonly available and widely used modeled measures. Vendors attempt to model each person’s likelihood of voting in a given election – be it primary, midterm or presidential. Pollsters use this information in building likely voter models, and campaigns use it to allocate resources for mobilization or persuasion. While turnout models are based on voter turnout in previous elections, some also include demographic information and partisanship in the model in an attempt to more accurately predict likely voting behavior.

Modeled turnout scores are typically treated as probabilities and are offered on a 0 to 100 scale, with 0 being the least likely to turn out to vote in a given election and 100 being the most likely to vote. (File 3 did not provide a turnout probability.) Each vendor has its own “secret sauce” that goes into their model. As a result, while all of the models follow a similar 0 to 100 scale, each scale has a different mean and distribution.

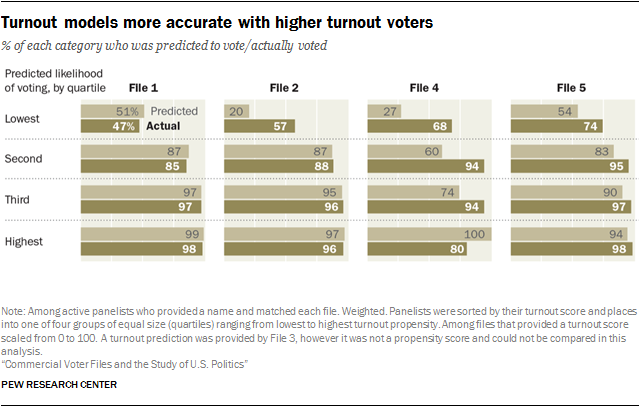

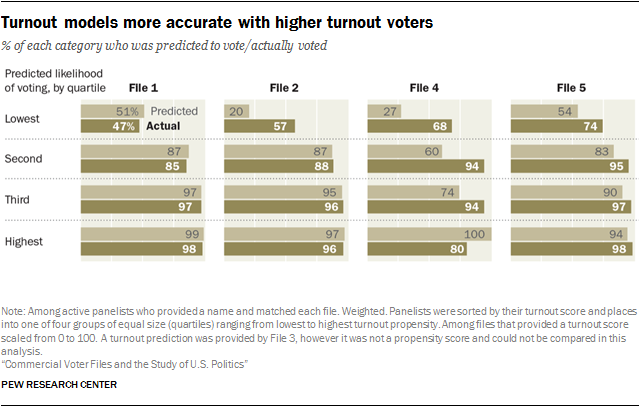

To assess the accuracy of the turnout predictions for the 2016 general election, panelists matched by each vendor were sorted by their predicted likelihood of voting into four groups of equal size, referred to here as quartiles. Within each quartile, the average turnout score – the mean of the predicted probabilities for that group – can be compared with the percentage of the group that actually voted. If the predictions are perfectly accurate, the mean of the predicted probabilities and the percentage who voted will be about the same.

The vendors varied somewhat in the accuracy of their turnout predictions. For three of the four, predictions about turnout among the quarter of the sample rated least likely to vote tended to underestimate the true turnout rate. For example, the average predicted probability of turning out for the lowest quartile in File 4 was just 27%, but among this group 68% actually voted. Two other files (File 2 and File 5) also underestimated actual turnout in the lowest quartile. By contrast, the average predicted turnout for the lowest quartile in File 1 was 51%, and the actual turnout was nearly the same, at 47%.11

Most of the vendors did better with their predictions among voters judged as highly likely to vote, though one of them (File 4) substantially overestimated the share in the highest quartile who would vote.

Since these scores can be used to predict who will turn out to vote, they can also be judged by how well they modeled the outcome of the election among those who did vote. Using a technique similar to that employed by pollsters to create a “likely electorate” among respondents to a pre-election survey, panelists who responded to a post-election survey were weighted by their pre-election likelihood of turning out to vote in 2016 (along with the usual survey weighting on demographic and related characteristics).

Since these scores can be used to predict who will turn out to vote, they can also be judged by how well they modeled the outcome of the election among those who did vote. Using a technique similar to that employed by pollsters to create a “likely electorate” among respondents to a pre-election survey, panelists who responded to a post-election survey were weighted by their pre-election likelihood of turning out to vote in 2016 (along with the usual survey weighting on demographic and related characteristics).

While self-reported voters in the panel as a group gave Clinton a 7-point advantage (50% for Clinton vs. 43% for Trump), weighting the results by the expected turnout scores from each file produced a result closer to the actual election outcome, which was a 2-point Clinton advantage in the national vote. All the files came close to the actual vote, showing either a 3- or a 4-point Clinton advantage.

Demographic data

As use of commercial voter lists by campaigns and public opinion researchers has grown, data offerings provided by voter file vendors have expanded. On top of standard political offerings, many vendors now provide a host of additional demographic and lifestyle data generated through predictive models or gathered from other sources. This chapter compares demographic data in the voter files with self-reports from panelists.

Predictive models leverage data from a mix of third-party commercial vendors and survey data to try to predict a number of characteristics, ranging from a person’s race to educational attainment. However, for some modeled variables, much of the underlying information is available only in a portion of states. For example, vendors rely on a mix of information from voter records and additional data to predict an individual’s race or ethnicity. In 16 states or portions of states, largely in the South, the Voting Rights Act of 1965 mandated that states list voters’ race on the state voter rolls. However, in states where this information is not available, vendors attempt to use information from other sources such as identifying common surnames or if someone lives in an area that is densely populated by a particular race.

In addition to state voter records and commercial data, some voter file vendors use survey data to enhance and build their models. Partisan vendors, in particular, often feed survey data from partner organizations into the models to improve their accuracy.

Race and ethnicity are generally well measured in the files

Given the central importance of race and ethnicity in American politics, voter file vendors attempt to identify the race of the individuals in the file. Vendors may use race as recorded on state voter records in places where the states are required to collect it. In other locations, race may be modeled using information like surname or geographic concentration.

Given the central importance of race and ethnicity in American politics, voter file vendors attempt to identify the race of the individuals in the file. Vendors may use race as recorded on state voter records in places where the states are required to collect it. In other locations, race may be modeled using information like surname or geographic concentration.

The modeled race and ethnicity of panelists was compared with how panelists described it when they were recruited to the panel (or in subsequent profile surveys). Overall, most vendors are able to accurately identify the race of white respondents, with rates of correct identification varying between 81% for File 3 to 97% for File 2. However, when it comes to accurately identifying the race of self-reported black and Hispanic panelists, some vendors are more accurate than others.

Among panelists who self-report being black in a survey measure, roughly three-quarters in Files 2 and 5 (74% in File 5 and 76% in File 2) are correctly classified as black by the respective models. However, the model in File 1 identifies far fewer black panelists accurately (56%).

In classifying self-reported Hispanic panelists, there is less of a difference across the files, ranging from a low of 64% of Hispanics correctly classified in File 3 to 75% in Files 1 and 5.

Overall, the rate of correct classification by race ranges from 74% for File 3 to 85% for File 2.

Other demographic variables vary greatly in accuracy

In addition to information provided by state voter rolls, many voter file vendors include information from other public and commercial data sources. This data could originate from a variety of sources, such as from magazine subscriptions or credit bureaus, with the goal of providing additional information about Americans beyond what is available directly from state voter lists.

The presence of commercial data in voter files is widespread; however, the specific variables available differ by vendor. Many vendors possess financial data from credit bureaus or credit card companies, including things like home price and mortgage amount. In addition, some vendors provide information like occupation, income and the number of adults or children in a household. The presence of hunting or fishing licenses is one of the most ubiquitous commercial variables.

This commercial data also presents itself in several ways. Some of these variables stand alone as flags, such as the presence of a hunting license, while others are included in models to predict particular outcomes or demographics. For example, several vendors provide models for personal interests like being a gun owner or a boating enthusiast – information that is modeled based on sources such as magazine subscriptions.

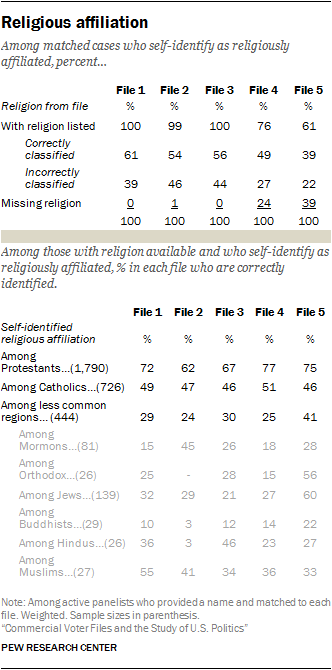

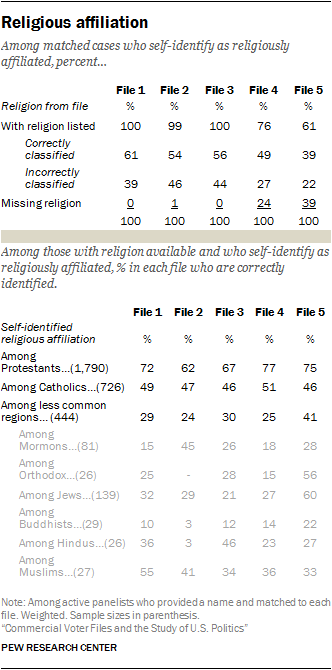

An analysis of three of the more commonly available commercial variables – education, income and religious affiliation – shows that some models are more accurate than others. Overall, most vendors had a higher rate of accuracy in predicting education than income. When it comes to religious affiliation, vendors for the most part correctly predict large religions in the U.S. such as Protestantism but have less success with lower incidence religions like Buddhism.

One common issue across many of the models is the preponderance of missing data, with large portions of matches listed as unclassified on some variables. For example, in assessing models produced to predict educational attainment, more than half (57%) of matches in File 4 and one-quarter (25%) of matches to File 5 are listed as unclassified.

One common issue across many of the models is the preponderance of missing data, with large portions of matches listed as unclassified on some variables. For example, in assessing models produced to predict educational attainment, more than half (57%) of matches in File 4 and one-quarter (25%) of matches to File 5 are listed as unclassified.